How to write a non vat official receipt

Note: This is subject to change in the future depending on BIR rules As such, if the taxpayer exceeds the gross annual sales or receipt threshold, they will automatically be classified as VAT registered. Because the computation of tax due is based on Gross Quarterly Sales.

It can be added to the selling price or service fee collected from customer.

3 Steps in Writing a NON-VAT Official Receipt

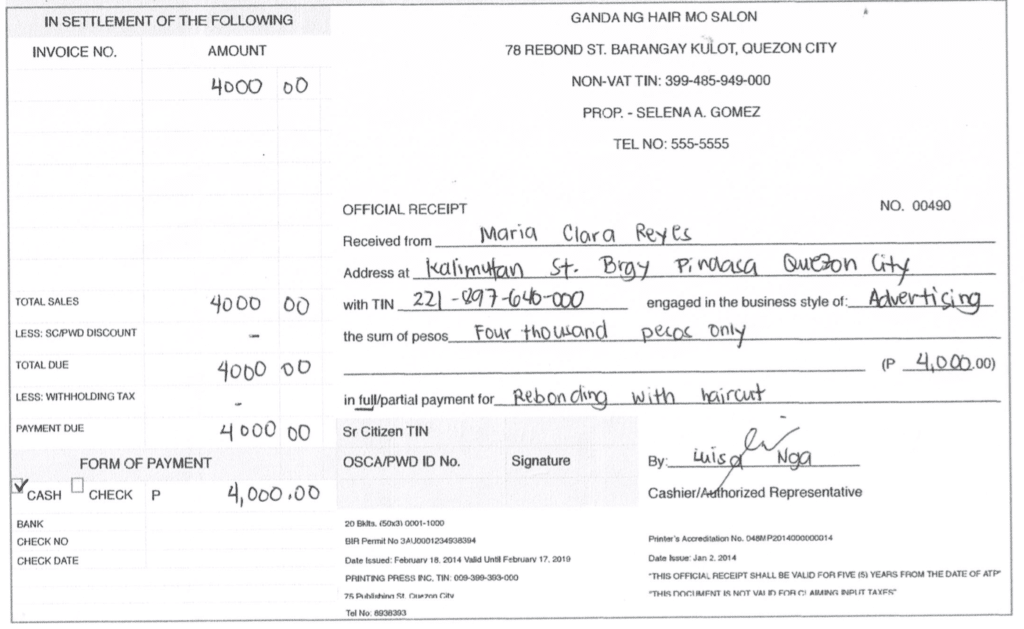

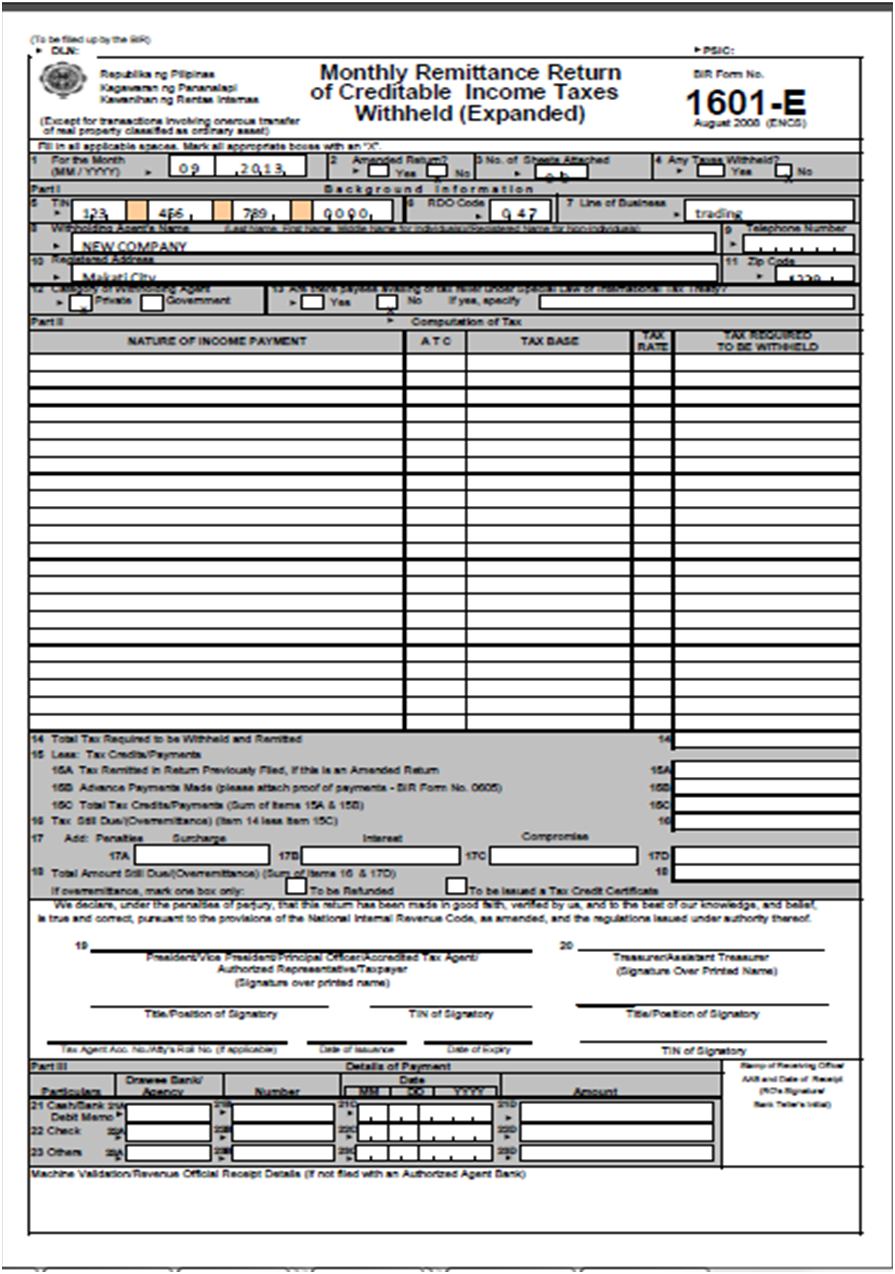

Most receipt booklets will already have a different receipt number for each receipt. Write your company phone number and address under the company name. No withholding tax was deducted from the payment. Amount collected: Full amount of P4, will be collected With More info Withholding Tax BIR FORM For collection of sales with credible withholding tax BIR formcomputation of the amount to be collected is as follows: Determine the amount of gross sales Determine the withholding tax rate applicable Compute the amount of withholding tax by multiplying the amount of gross sales by the applicable withholding tax rate.

BGC Corporation rented a space for a monthly rental fee of P8, Ang natanggap na ay maaaring gamitin bilang how to write a non vat official receipt credit o pambawas sa income tax due. Maaaring hingin ang COR o proof ng customer para malaman kung qualified sila nag mag-withhold ng tax sa seller.

Maliban na lang kung ang seller ay lessor o nagpapaupa. For comments, you may please send mail at info taxacctgcenter.

Some Benefits of always Having an Official Receipt of Your Purchases

For comments, you may also please send mail at info taxacctgcenter.

How to write a non vat official receipt - the helpful

Bookkeeping is a complicated, routinely and often redundant task which takes up significant time when performed manually or using poorly designed tools. For small amount, you can automate the process of your accounting, tax preparation and filing which will save you a lot of time and prevent errors. Other types of receipt and invoice will be covered in separate articles.As of the date of writing, the limit is P1, For the updated amount of limit, you may visit the BIR website.

What necessary: How to write a non vat official receipt

| How to logout of instagram app on phone | What is my amazon prime code for whole foods |

| WHAT ARE ALL THE BENEFITS DO U More info WITH AMAZON PRIME SUBSCRIPTION | 986 |

| How to write a non vat official receipt | If in case you are How to write a non vat official receipt registered and your input tax (vat on expenses) exceeds output tax (Vat on sales), you may claim for refund on the excess or difference.

3.  Decreases Tax Payments. Another importance of asking for an official receipt is that it can be used to legally minimize or decrease tax payables. Nov 08, · Look at an invoice or insurance document to find a VAT number. VAT numbers are usually printed on an invoice or receipt—especially if the company includes the VAT tax in their prices. They are occasionally printed on insurance forms or claims as well.  To find a VAT number, look for 2 letters followed by a hyphen and numbers. A NON-VAT BIR registered taxpayer are required to file and pay monthly percentage tax (BIR form M). 3 Steps in Writing a NON-VAT Official Receipt Step 1: Compute and collect the amount of sales. Before you issue an official receipt to your customer, you need to first consider the following. |

| How to write a non vat official receipt | Nov 08, · Look at an invoice or insurance document to find a VAT number. VAT numbers are usually printed on an invoice or receipt—especially if the company includes the VAT tax in their prices. They are occasionally printed on insurance forms or claims as well. To find a VAT number, look for 2 letters followed by a hyphen and numbers. A NON-VAT BIR registered taxpayer are required to file and pay monthly percentage tax (BIR form M). 3 Steps in Writing a NON-VAT Official Receipt Step 1: Compute and collect the amount of sales. Before you issue an official receipt to your customer, you need to first consider the following. What is a NON-VAT BIR Registered Taxpayer?If in case you are VAT registered and your input tax (vat on expenses) exceeds output tax (Vat on sales), you may claim for refund on the excess or difference. 3.  Decreases Tax Payments. Another importance of asking for an official receipt is that it can be used to legally minimize or decrease tax payables. |

![[BKEYWORD-0-3] How to write a non vat official receipt](https://mpm.ph/wp-content/uploads/2016/07/Screen-Shot-2016-07-19-at-6.29.23-PM-1024x629.png)

How to write a non vat official receipt Video

Unregistered Sales Invoice and Official Receipt 😊What level do Yokais evolve at? - Yo-kai Aradrama Message