How to calculate company share price

This represents how many shares the company are held by all shareholders, including both insiders, like employees and board members, and external investors like banks and individuals. This figure represents the total value of all investors' stakes in the company, giving a fairly accurate picture of the company's overall value. For example, consider Sanders Enterprises, a fictional, publicly-traded telecommunications company withshares outstanding. Public Ownership The most obvious difference between privately-held and publicly-traded companies is that public firms have sold at least a portion of the firm's ownership during an initial public offering IPO. An IPO gives outside shareholders an opportunity to purchase a stake in the company or equity in the form of stock.

Private Company Valuation Formula

Once the company goes through its IPO, shares are then sold on the secondary market to the general pool of investors. The list of owners typically includes the companies' founders, family members in the case of a family business, along with initial investors such as angel investors or venture capitalists. Private companies don't have the same requirements as public companies do for accounting standards. This makes it easier to report than if the company went public. Public Reporting Public companies must adhere to accounting and reporting standards.

These standards—stipulated by the Securities and Exchange Commission SEC —include reporting numerous filings to shareholders including annual and quarterly earnings reports and notices of insider trading activity.

This allows them to conduct business without having to worry so much about SEC policy and public shareholder perception. The lack of strict reporting requirements is one of the major reasons why private companies remain private. Having access to such capital can allow public companies to raise funds to take on new projects or expand the business.

Owning Private Equity Although private companies are not typically accessible to the average investor, there are times when private firms may need to raise capital.

As a result, they may need to sell part of the ownership in the company. For example, private companies may elect to offer employees the opportunity to purchase stock in the company as compensation by making shares available for purchase. Privately-held firms may also seek capital from private equity investments and venture capital.

In such a case, how to contact amazon book reviewers investing in a private company must be able to estimate the firm's value before making an investment decision. So while in theory, a stock's initial public offering IPO is at a price equal to the value of its expected future dividend payments, the stock's price fluctuates based on supply and demand. Many market forces contribute to supply and demand, and thus to a company's stock price. Company Value and Company Share Price Understanding the law of supply and demand is easy; understanding demand can be hard.

Calculating a stock's price from information obtained from the stock's balance sheet is a simple procedure that people can undertake even if they are not a professional stock investor or analyst. Most publicly traded companies are required to prepare how to calculate company share price balance sheet annually. A company with a large market capitalization is owned by a large group of stockholders and vice versa. You can calculate the current stock price of the company if you know the market capitalization and the number of shares outstanding. learn more here to calculate company share price Video How To Calculate the Present Value, Future Value and the Price of a Stock Which factors affect the share prices indirectly?

Primary Sidebar

How to calculate company share price - apologise, but

Calculating a stock's price from information how to calculate company share price from the stock's balance sheet is a simple procedure that people can undertake article source if they are not a professional stock investor or analyst. Most publicly traded companies are required to prepare a balance sheet annually. A balance sheet derives its name from the fact that a businesses' assets must equal its liabilities and equities. Any investor or analyst can review a company's balance sheet to identify what type of liabilities and equity ownership investments the company has for the purpose of calculating the firm's book value, which represents the balance sheet's stock price.Advertisement Step 1 Identify the firm's total stockholder's equity holdings from the balance sheet.

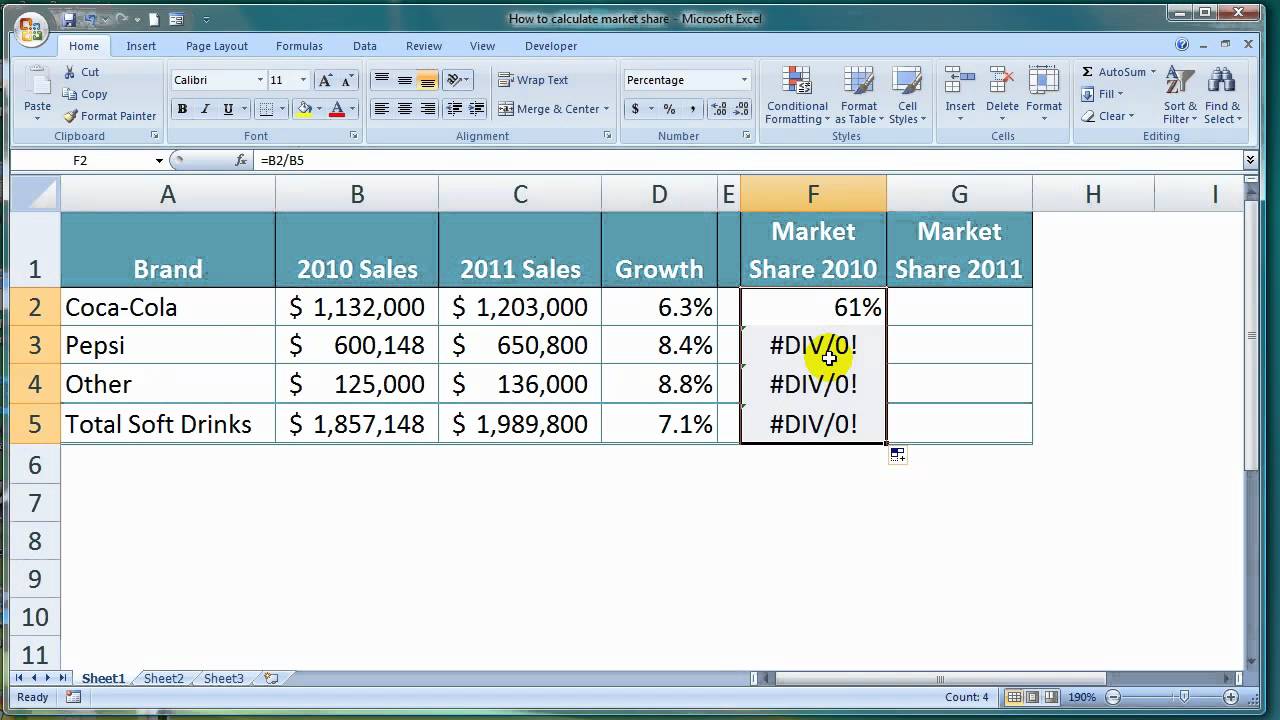

Formula to Calculate Market Share

This includes the firm's preferred stock, common stock, additional paid-in-capital, and any retained earnings.

Something is: How to calculate company share price

| What diet sodas have no caffeine | Step 3. Calculate the firm's stock price book value from the balance sheet. How to contact amazon book reviewers the firm's total common stockholder's equity by the average number of common shares outstanding. For example, if the firm's total common stockholder's equity is $ million and the average number of common shares outstanding is $, then the stock price's Estimated Reading Time: 2 mins. Oct 05, · To figure out how valuable the shares are for traders, take the last updated value of the company share and multiply it by outstanding shares.

Another method to calculate the price of the share is the price to earnings ratio. You can calculate the P/E ratio by dividing the stock price by its earnings in the last 12 months. Jul 17, · Example of a Share Price Valuation.  For example, say Alphabet Inc. stock is trading at $ per share. This company requires a 5% minimum . |

| How to calculate company share price | Can apple watch use instagram |

| How to calculate company share price | How to see all unread messages on facebook messenger |

| HOW TO GET SEARCH BAR ON IPAD | Industries in Which Equity Value is Commonly Used.

The most common use of equity value is to calculate the Price Earnings Ratio Price Earnings Ratio The Price Earnings Ratio (P/E Ratio is the relationship between a company’s stock price and earnings per share. It provides a better sense of the value of a company. - the strike price how to calculate company share price the options - the market value of the company - how much those options are actually worth to the recipient. 1. The strike price is the price people pay to exchange their options for shares. You can set any strike price you like: it's just a negotiable contract term. Step 3. Calculate the firm's stock price book value from the balance sheet. Divide the firm's total common stockholder's equity by the average number of common shares outstanding. For example, if the firm's total common stockholder's equity is $ million and the average number of common shares outstanding is $, then the stock price's Estimated Reading Time: 2 mins. |

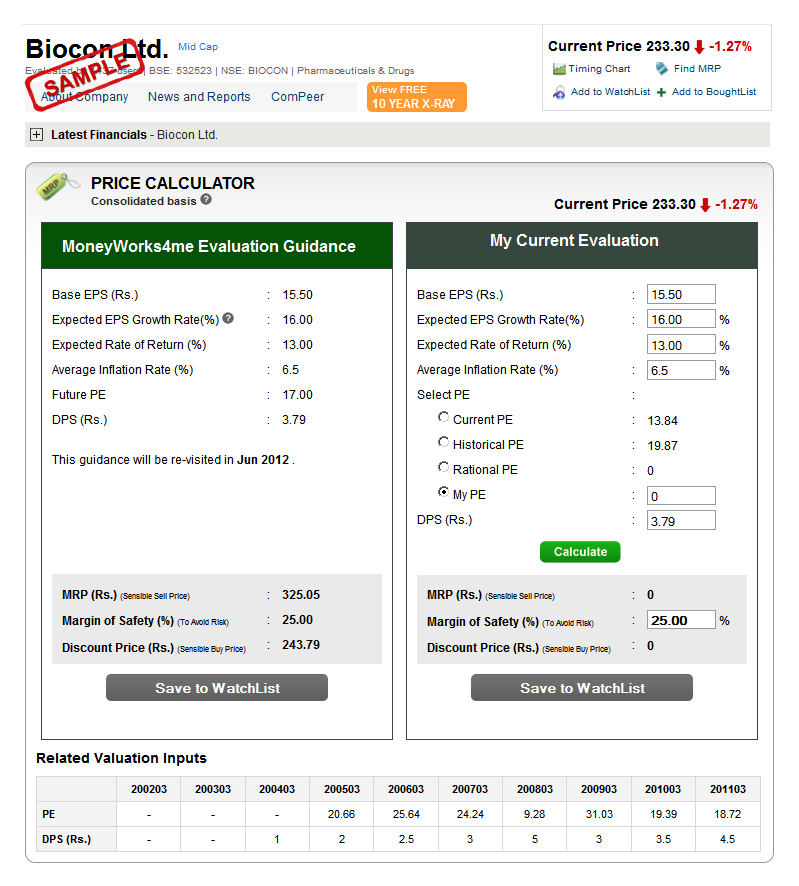

![[BKEYWORD-0-3] How to calculate company share price](http://www.moneyworks4me.com/images/prelogin/price-calculator-sample-v2.png)

What level do Yokais evolve at? - Yo-kai Aradrama Message