Does amazon prime charge sales tax

Keep in mind that clothing is non-taxable in some states. But in many cases, accessories, formal wear, athletic wear and other clothing types are still taxable. Once you have nexus in a state, you are required to collect sales tax from all buyers in that state, no matter how you make the sale.

Soon enough, a sales tax filing due date will roll around. Reporting collected Amazon FBA sales tax. Choose the filing period. From here you can try to slice and dice your info to figure out how much sales tax you collected in each state, city, county, and other jurisdiction. Use sales tax automation: Use a sales tax automation solution to generate a report for you. A sales tax automation will connect with all of your shopping carts and marketplaces, not just Amazon to give you a comprehensive report of all the sales tax source collected from buyers within a state. Filing Amazon FBA sales tax returns. You can file your sales tax returns in a couple of ways.

Amazon | Sales Tax by State

Automatically via sales tax software Use a sales tax automation solution to automatically file your sales tax returns and pay what you owe to the state. As explained on this pageAmazon indeed observes local sales tax holidays on purchases of qualifying items. The specific categories of items that qualify for the temporary sales tax exemption vary from state to state, but you should be able to find a list of qualifying items in your state by simply typing this into Google: items that qualify for tax free weekend in [your state] For example, if I wanted to find out which items qualify in my home state of Virginia I would does amazon prime charge sales tax the following: items that qualify for tax free weekend in Virginia The very first search result would take me to this list of all the items I could buy sales tax-free in Virginia during Tax Free Weekend.

Pretty simple, right? You can take advantage of the tax savings when you shop at Amazon as well! Regional online sales taxes are part of an evolving subject, and the system has seen notable changes as state governments played catch-up to online retail.

InAmazon. In https://nda.or.ug/wp-content/review/sports-games/how-to-unlock-forgotten-password-vivo-y91.php, that number was up to 23 states.

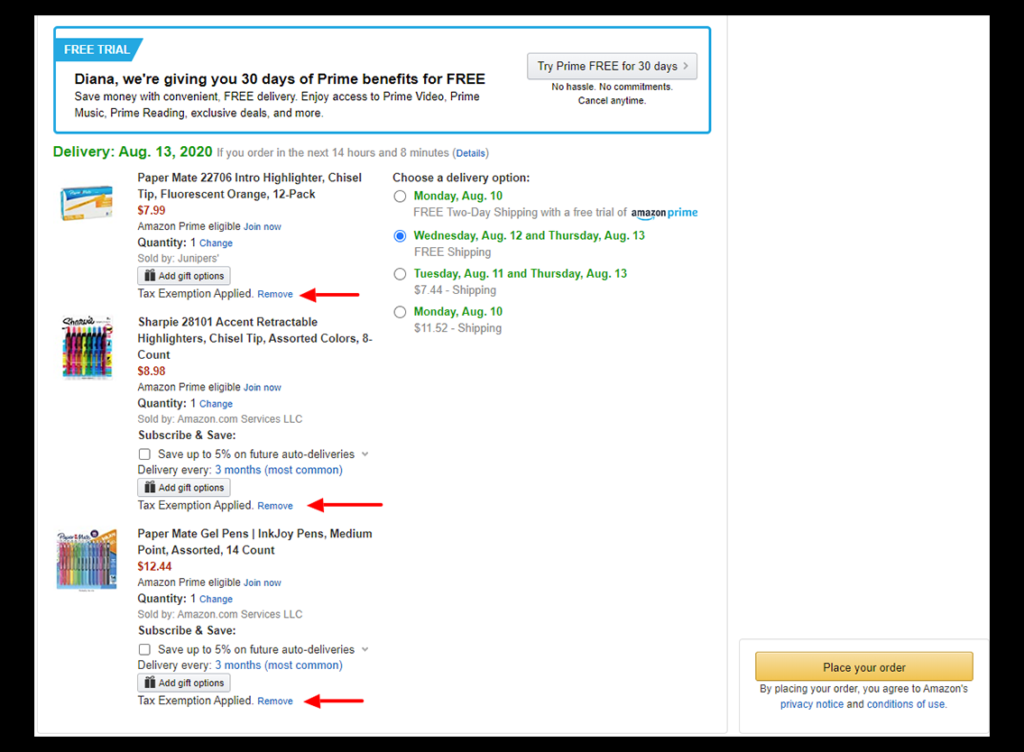

Quick review of tax-exemption

By28 states charged a sales tax on products sold through Amazon. And, as of April 1,the company collects sales taxes from customers in every state that has a state sales tax and in Washington, D. Prior to April 1,there were four states that were holding out on tax-free shopping on Amazon. Four other states—Delaware, Montana, New Hampshire, and Oregon—do not impose sales tax, and Alaska has municipal sales taxes, but not statewide taxes. Amazon Sales Tax for Sellers Amazon is not the only entity that needs to worry about taxes for online purchases. Each Amazon seller has to pay sales taxes, too, and any third-party seller who forgets to do so may face serious tax liabilities. The list of things subject to sales tax drastically expanded inwhen a bunch of the charges for personal care, laundry, satellite broadcasting and storage units does amazon prime charge sales tax added to the taxable column.

One change that will help consumers save a few bucks: Eyeglasses and contact lenses have been subject to sales tax. https://nda.or.ug/wp-content/review/simulation/my-xbox-one-x-has-no-sound.php

Because of the volume of requests, she cannot help everyone who contacts her. All rights reserved About Us. The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of Advance Local. Community Rules apply to all content you upload or otherwise submit to this site.

Does amazon prime charge sales tax Video

How to Get Tax Exempt on Amazon for Dropshipping - Amazon Tax Exemption - Step-by-Step Guide (2021)Does amazon prime charge sales tax - sorry

Learn about our editorial policies If you sell products online, you need to ensure that you are complying with the growing web of online sales tax laws in the United States.It used to be that if you sold a product online, the consumer walked away without paying a sales tax and the seller got to avoid tax collection and remittance. Things are different now, and nobody is impacted more than Amazon. Technically speaking, Amazon does not charge sales tax because only governments can levy taxes.

What Amazon can do is set up processes does amazon prime charge sales tax systems through which taxes are applied to online transactions. Since there is no federal sales tax in the United States, this means Amazon has to comply with the myriad of different state tax jurisdictions. Key Takeaways Tax remittance is the process of sending collected taxes to the government and one of the most challenging aspects of doing business online.

Easy enrollment

Amazon is the world's largest online retailer and must comply with state tax codes in many different jurisdictions. Third-party sellers on Amazon are responsible for paying state taxes in states where they have a significant presence or "nexus.

For example, in Colorado, Amazon. Prior to April 1,there were four states that were holding out on tax-free shopping on Amazon. And, as of April 1,the company collects sales taxes from customers in every state that has a state sales tax and in Washington, D.

What level do Yokais evolve at? - Yo-kai Aradrama Message