How to find tax invoice on ebay

View cart for details.

Goods of any value sold by a non-EU seller and shipped from inventory stored in the EU. If an order fits either of these criteria, neither sellers nor carriers should collect VAT from buyers in the EU. This ensures that items imported from outside the EU no longer have preferential VAT treatment compared to items purchased from within the EU. Income tax Sellers may be required to declare and pay taxes on income earned from eBay sales. If you're selling on eBay as a business, we strongly recommend seeking professional advice about your tax obligations. If eBay is required to collect such taxes in your jurisdiction, eBay will add the tax as a separate charge on your seller invoice or include the tax in our fees. Please ensure that your registration address - opens in new window or tab is up to date, so that we know where you are based. How to find tax invoice on ebay for tax exemption on your eBay fees If you use your eBay account exclusively for business purposes, you may apply for tax exemption on your eBay fees - opens in new window or tab by providing us with your tax registration number.

Once you've registered for tax exemption, your invoice will show your tax registration number, and be issued net of tax. If, after registering for tax exemption, your circumstances have changed and you no longer qualify as a business, please contact customer service. Select Save.

You can also customise your Transaction reports by selecting a specific payout from the Payouts tab. Any customisation you make from the Reports tab or Payouts tab will apply to all future Transaction reports.

You can return to the default settings any time by selecting Reset to default settings. The times in your Transaction report may not match the transaction times in your records due to the differences in international timezones, and may result in discrepancies between your Transaction report and other reports.

Below are some of the details you may find in your Transaction report, which individually or combined can help you with reconciliation: Item ID: The unique ID for the item Payout ID: The unique ID for the payout Reference ID: The unique ID for the transaction Transaction ID: The unique ID how to find tax invoice on ebay combines information about a buyer, item, and item price Net amount: The net amount you receive for the transaction Payout method: The linked checking account for the payout Status: The status of the transaction Reason for hold: Additional information about a hold transaction status Final value fee: A fee calculated as a variable percentage of the total amount of each sale, plus a fixed amount on each sale.

Payout report Your payout report provides a summary of your payouts for a specific date range. The best practice is to send refunds through the eBay platform. However, if the refund is carried out on the PayPal platform, the seller is responsible to refund the full amount paid by the buyer at checkout including any paid Internet Sales Tax. What is the policy?

Sellers are responsible for paying taxes associated with using eBay, in accordance with all applicable laws. Income tax Sellers may be required to declare and pay taxes on income earned from your eBay sales.

Tax on items bought and sold on eBay Many countries and jurisdictions around the world apply some sort of tax on consumer purchases, including items bought on eBay.

How to find tax invoice on ebay Video

How to find 1099 tax form for Ebay Managed PaymentsTheme: How to find tax invoice on ebay

| How to search instagram story filters | What happens to conversations when you delete tinder |

| How to find tax invoice on ebay | |

| How read article find tax invoice on ebay | 403 |

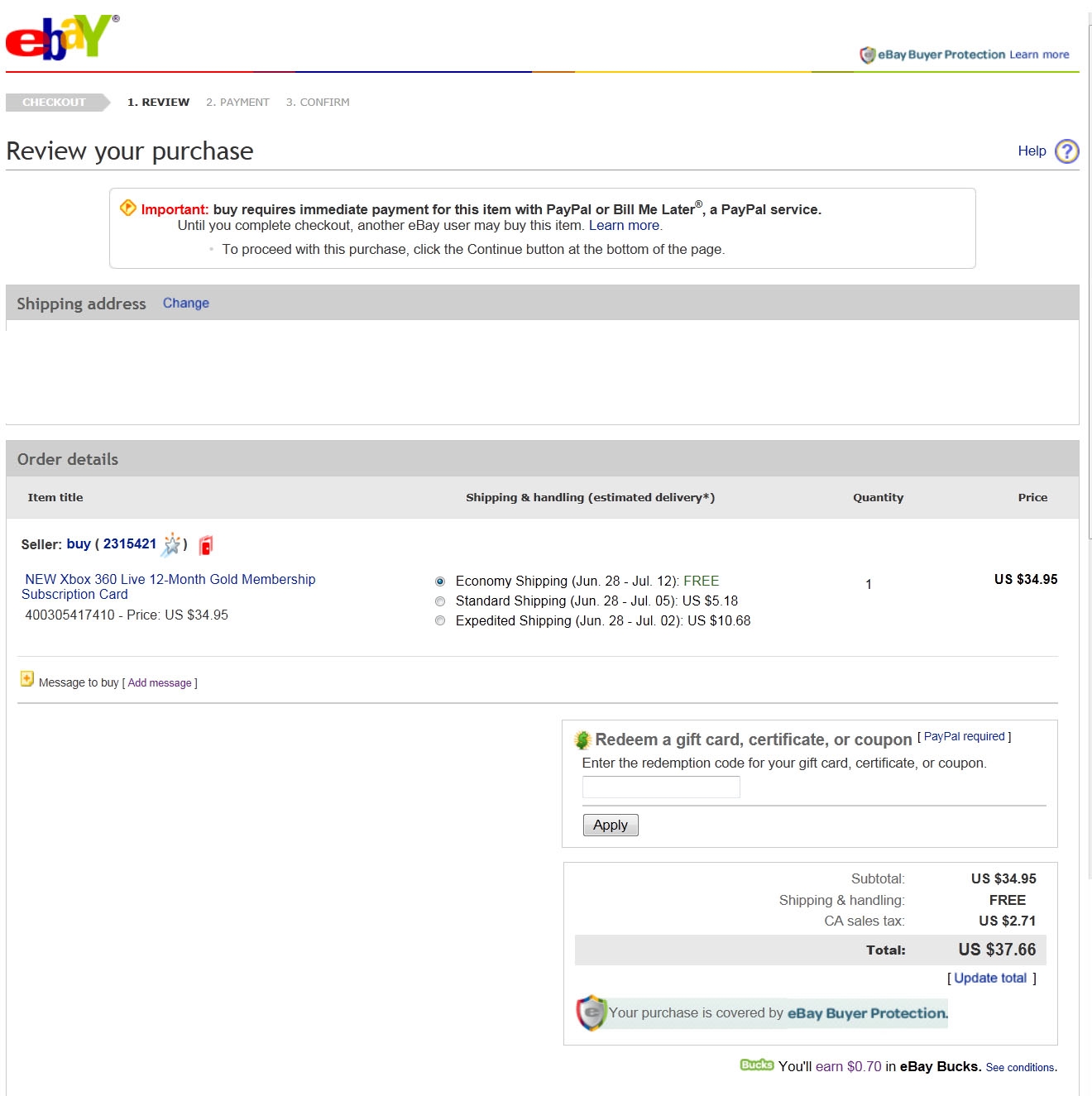

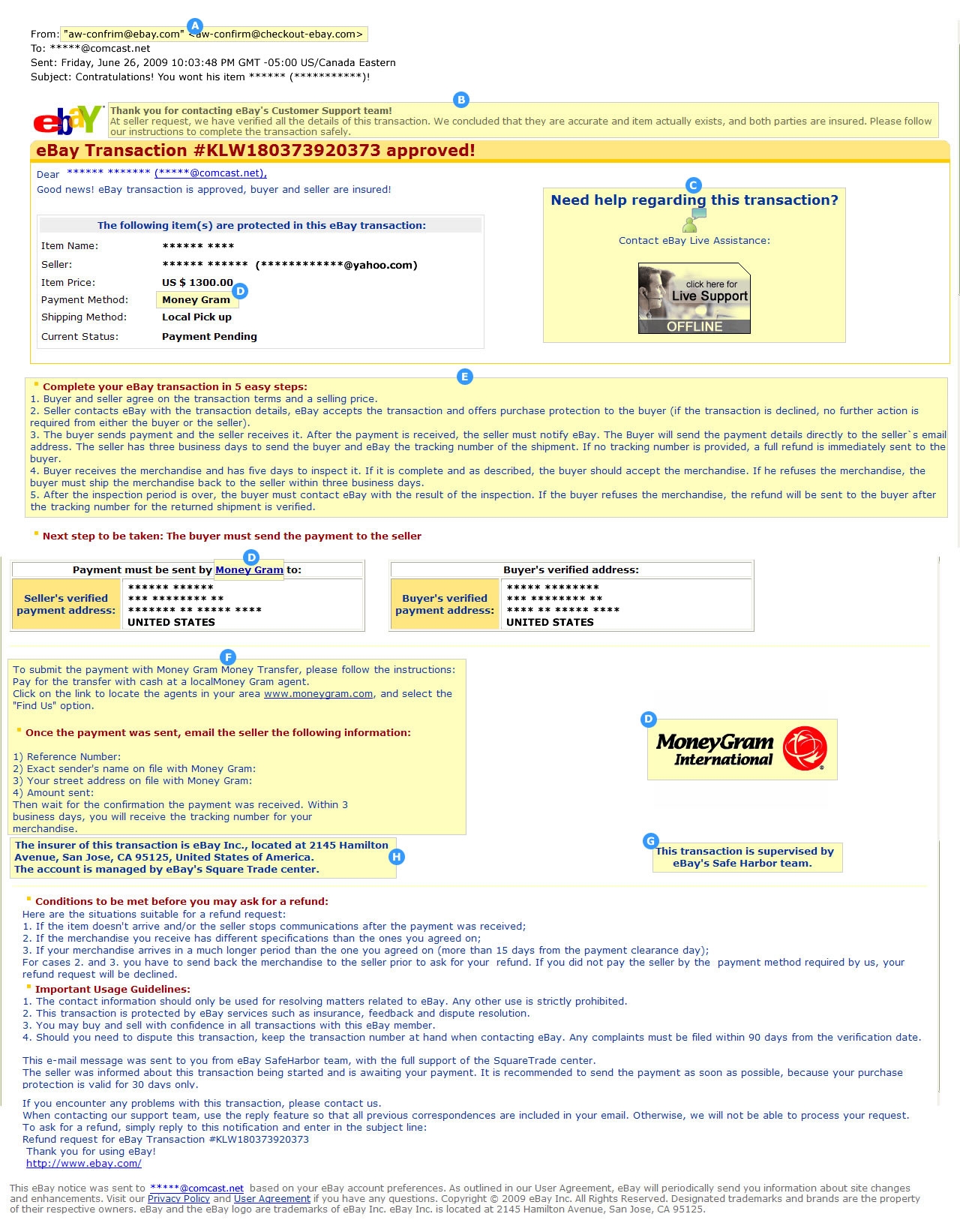

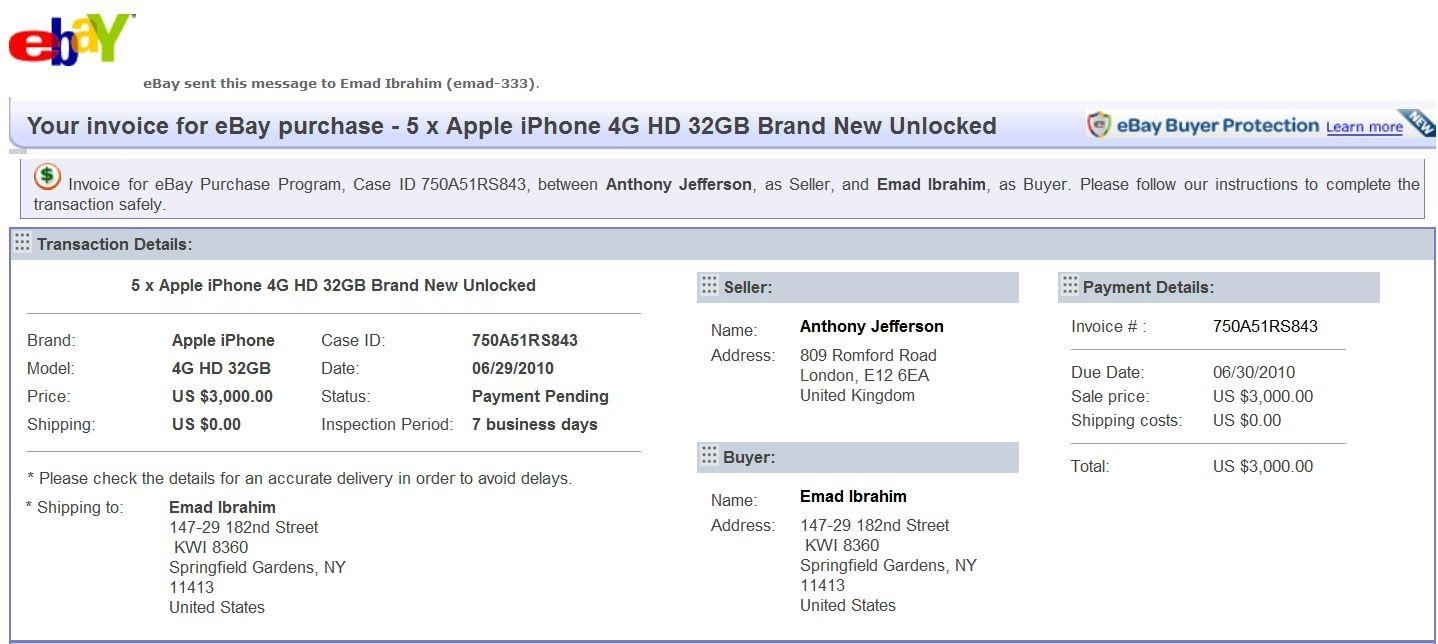

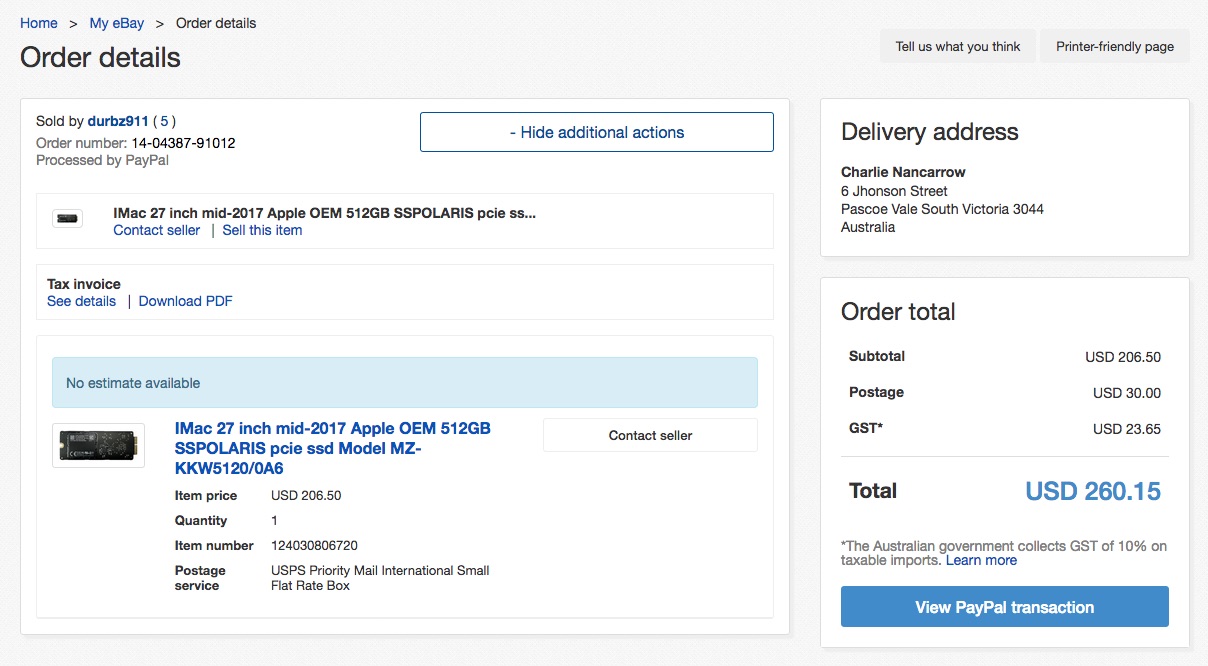

![[BKEYWORD-0-3] How to find tax invoice on ebay](https://simpleinvoice17.net/wp-content/uploads/2016/09/invoice-fee-for-159322-the-ebay-community-ebay-invoice-fee.png) .

.

How to find tax invoice on ebay - are

.What level do Yokais evolve at? - Yo-kai Aradrama Message