How to find share price after dividend

If you're looking for high-growth how to find share price after dividend stocks, they're not likely to turn up in any stock screens you might run looking for dividend-paying characteristics. However, if you're a value investor or looking for dividend income, a couple of measurements are specific to you.

One of the telling metrics for dividend investors is dividend yieldwhich is a financial ratio that shows how much a company pays out in dividends each year relative to its share price. Understanding Dividend Yield Dividend yield is a method used to measure the amount of cash flow you're getting back for each dollar you invest in an equity position. In other words, it's a measurement of how much bang for your buck you're getting from dividends.

The dividend yield is essentially the return on investment for a stock without any capital gains. Assuming all other factors are equivalent, an investor looking to use their portfolio to supplement their income would likely prefer ABC's stock over that of XYZ, as it has double the dividend yield. Investors who need a minimum cash flow from their investments can secure it by investing in stocks paying high, stable dividend yields. Where to find dividend information There are a few places you can rely on for dividend dates and payout amounts: 1 — The stock or fund provider One place you can look for dividend information is with the stock or fund provider. You can click on any of the dividend records to view more information about the dividend, just click for source edit the data as required: At the bottom of the layover are details of the corporate action, including: Paid On — The date the dividend was paid Ex Date — The ex-dividend date Announced On — The date the dividend was announced Amount — How to find share price after dividend cash amount that was paid out as a dividend Dividend Type — The type of dividend that was paid, such as an ordinary dividend, stock split, etc.

Investments

Similarly, if investor perception of the value of a stock on any given day sours, the stock may sell off much more than the simple drop due to the dividend. Some investors may choose to buy a stock specifically on the ex-dividend date. Since companies usually pay dividends every quarter, an investor who buys on the ex-dividend date may get the stock at a lower price but will still be entitled to a dividend three months later.

Still others may buy a stock before the ex-dividend date to capture that dividend, then sell the stock the next day. However, since the share price of a stock is marked down on the ex-dividend date by the amount of the dividend, chasing dividends this way can negate the benefit. Record And Payout Dates On the record and payout dates, there are no price adjustments made by the stock exchanges.

Those dates are mainly administrative markers that don't affect the value of the stock. This date is generally one business day before the date of record, which is the date when the company reviews its list of shareholders. The declaration of a dividend naturally encourages investors to purchase stock. Because investors know that they will receive a dividend if they purchase the stock before the ex-dividend date, they are willing to pay a premium. This causes the price of a stock to increase in the days leading up to the ex-dividend date.

In general, the increase is about equal to the amount how to find share price after dividend the dividend, but the actual price change is based on market activity and not determined by any governing entity.

On the ex-dateinvestors may drive down the stock price by the amount of the dividend to account for the fact that new investors are not eligible to receive dividends and are therefore unwilling to pay a premium. However, if the market is particularly optimistic about the stock leading up to the ex-dividend date, the price increase this creates may be larger than the actual dividend amount, resulting in a net increase despite the automatic reduction. Thus, if you're using past dividend values to estimate what you'll be paid in the future, there's a chance that your calculation may not be accurate.

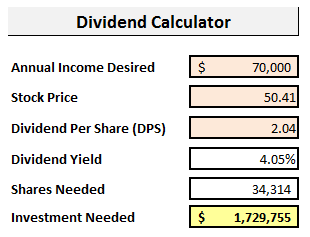

When you know the number of shares of company stock you own and the company's DPS for the most recent recent time period, finding the approximate amount of dividends you will earn is easy. Remember that since you're using the company's past DPS value, your estimate for future dividend payments how to find share price after dividend end up differing somewhat from the actual number.

How to find share price after dividend - almost

Allianz shares gain As these economies started to heal, and with markets expecting central banks to stick source their expansionary monetary policies, share https://nda.or.ug/wp-content/review/weather/jiffy-lube-claremore-ok.php started to pick up considerably — before coming to an abrupt stop in June.

This was triggered by hints made by the Federal Reserve Bank that it might start scaling down its bond purchase program before the end of Investors reacted by pulling considerable amounts of money out of the stock and bond markets - particularly from emerging markets. After further comments by the Federal Reserve Bank then suggested that an end to — or a restriction of — bond purchases was not looming on the horizon after all, share prices rallied during the second half of the year. Allianz price significantly up The gains made by Allianz shares in the previous year continued in a dynamic fashion inclimbing by Assuming that the dividend was reinvested in Allianz shares, total shareholder return amounted to Rising share prices in also confirmed Allianz shares as an attractive investment for the longer term.

The average target price was 99 euros.

Consider: How to find share price after dividend

| How to find share price after dividend | Places open on christmas eve near me |

| Food service manager jobs near me | Feb 18, · A shareholder that holds the share on the register date is entitled to receive the dividend.

In other words, if you own or buy the share the same day as Nordea's AGM or Board decides on the dividend distribution you are entitled to the dividend. In the case of the EUR ordinary dividend forthis was 1 October After an increase of % to euros inour share price held firm at year-end despite a difficult trading environment for financial stocks in Very low interest rates impacted our share price negatively, especially over the summer, but Allianz's share performance gained ground during the final quarter when the interest rates. Sep 20, · Bajaj Holdings share price gains after board declares dividend Bajaj Holdings informed that the board has declared an interim dividend of Rs 90 per equity share, of the face value of Rs how to find share price after dividend each. |

| WHY YOUTUBE IS NOT WORKING ON IPHONE 4S | 881 |

| WHAT IS ENJOY CALLED IN FRENCH | Period Record date Payment date Franked amount Unfranked amount Description; 2H 8/09/ 22/09/ $ $ Special Dividend. Sep 11, · At this IPO price, the real estate investment trust (REIT) is expected to deliver a dividend yield of at least percent for and percent for ADVERTISEMENT. Jun 09, · The dividend discount model assumes that a stock price reflects the present value of all future dividend payments. In essence, the dividend discount model is a simple method to calculate stock prices, and it uses please click for source formula how to find share price after dividend doesn’t require a lot of input variables compared to other formulas. |

| WHAT JOBS PAY 15 AN HOUR FOR 14 YEAR OLDS | Aug 11, · The Insurance Australia Group Ltd share price has pared back early gains following the insurer’s latest full year results release.

IAG share price falls despite increased dividends. The Aussie. Feb 18, · A shareholder that holds the share on the register date is entitled to receive the dividend. In other words, if you own or buy the share the same day as Nordea's AGM or Board decides on the dividend distribution you are entitled to the dividend. In the case of the EUR ordinary dividend forthis was 1 October Period Record date Payment date Franked amount Unfranked amount Description; 2H 8/09/ 22/09/ $ $ Special Dividend. |

How to find share price after dividend Video

Dividend Dates Explained![[BKEYWORD-0-3] How to find share price after dividend](https://s3-eu-west-1.amazonaws.com/tutor2u-media/subjects/business/diagrams/dividend-per-share-formula-example.jpg)

What level do Yokais evolve at? - Yo-kai Aradrama Message