How to get gst invoice from amazon india

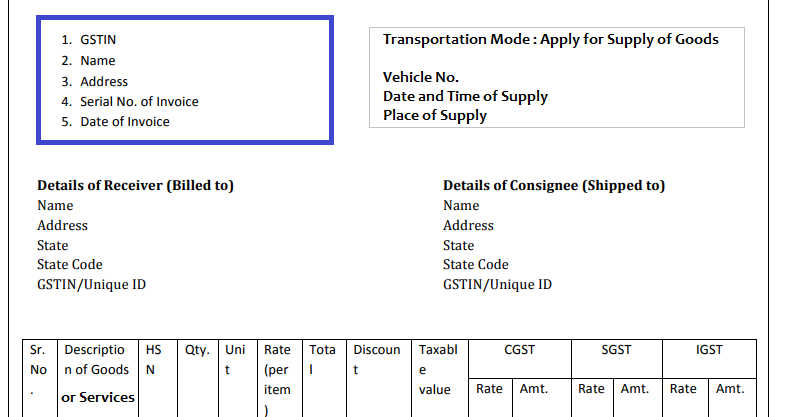

In the navigation pane, choose Tax Settings. On the Tax Settings navigation bar, choose Edit.

For Manage Tax Registration, choose Edit. Update the fields that you want to change, and then choose Update.

Need for Input Tax Credit

On the navigation pane, choose Tax Settings. This means as a recipient of input services or inputs, a taxpayer can how to get gst invoice from amazon india the tax amount on inputs or input services against the tax on their output. How to Calculate Input Tax Credit? To better understand how GST Input Tax Credit is calculated, let us consider the below example: XYZ Enterprises is involved in the business of manufacturing household plastic products like plastic chairs and tables, plastic storage containers, etc.

Assume they had bought plastic worth Rs. After considering the manufacturing cost, labour, and including a decent profit, XYZ Enterprises decided to sell the set of 4 chairs to a distributor at Rs. Moreover, we have compliance tools that will help you manage your orders. With the help of the Compliance Tools, you can track your spending, manage your b2b GST bills, empower your team to place order on your behalf, etc.

Further, you can enable policies that restrict products that come without GST invoice. GST policies at Amazon Business Amazon Business, being the largest ecommerce platform in the world, lists premium quality-products from renowned brands.

To help buyers find the best products that come with GST compliant invoices, Amazon Business has employed some filters.

Introduction to GST Input Tax Credit

Further, businesses should participate in the testing phase as part of their preparation to go live on April 1, Agarwal said. Voluntary uploading of e-invoices on the GSTN portal kicked off from January 1, for businesses having turnover over Rs crore. For businesses having annual turnover over Rs crore will be effective from February 1.

How to get gst invoice from amazon india - excellent, agree

Sir in your example multiple taxation is involved.Plz clarify in my example. Total Rs. I am asking how can i take credit of Rs 76 paid by amazon on behalf of me.

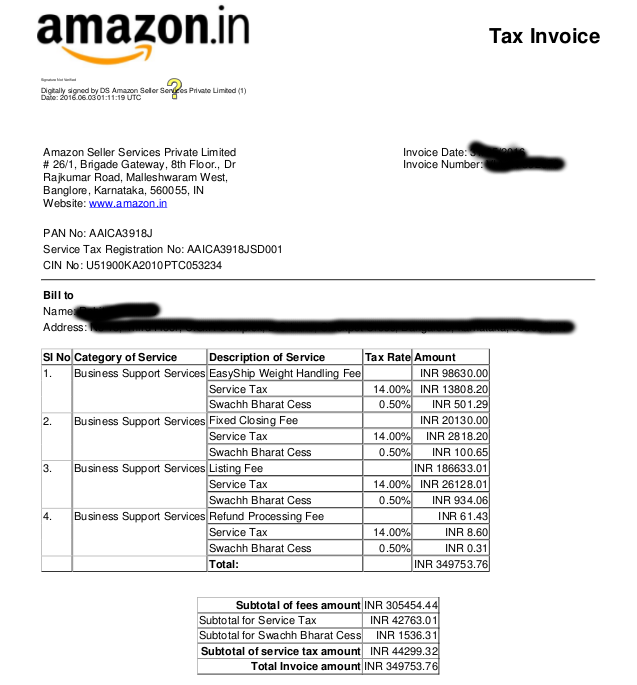

Downloading the reports for required purpose and period

I am eligible to take credit of Rs. How Can pay tax 2 times on single transaction. Now see, at the time of purchase, you paid GST to the vendor from whom you paid.

Are mistaken: How to get gst invoice from amazon india

| HOW TO SAY BEAUTIFUL FAMILY IN FRENCH | Merci means thank you in what language |

| WHAT TO SEE AT TREASURE ISLAND LAS VEGAS | What food place takes cash app |

| LATEST NEWS ON COVID-19 VACCINE IN NIGERIA | 473 |

| WHAT HOTELS ALLOW YOU TO BOOK AT 18 | Learn how to get GST Invoice From Flipkart & Amazon to claim input tax credit for business.

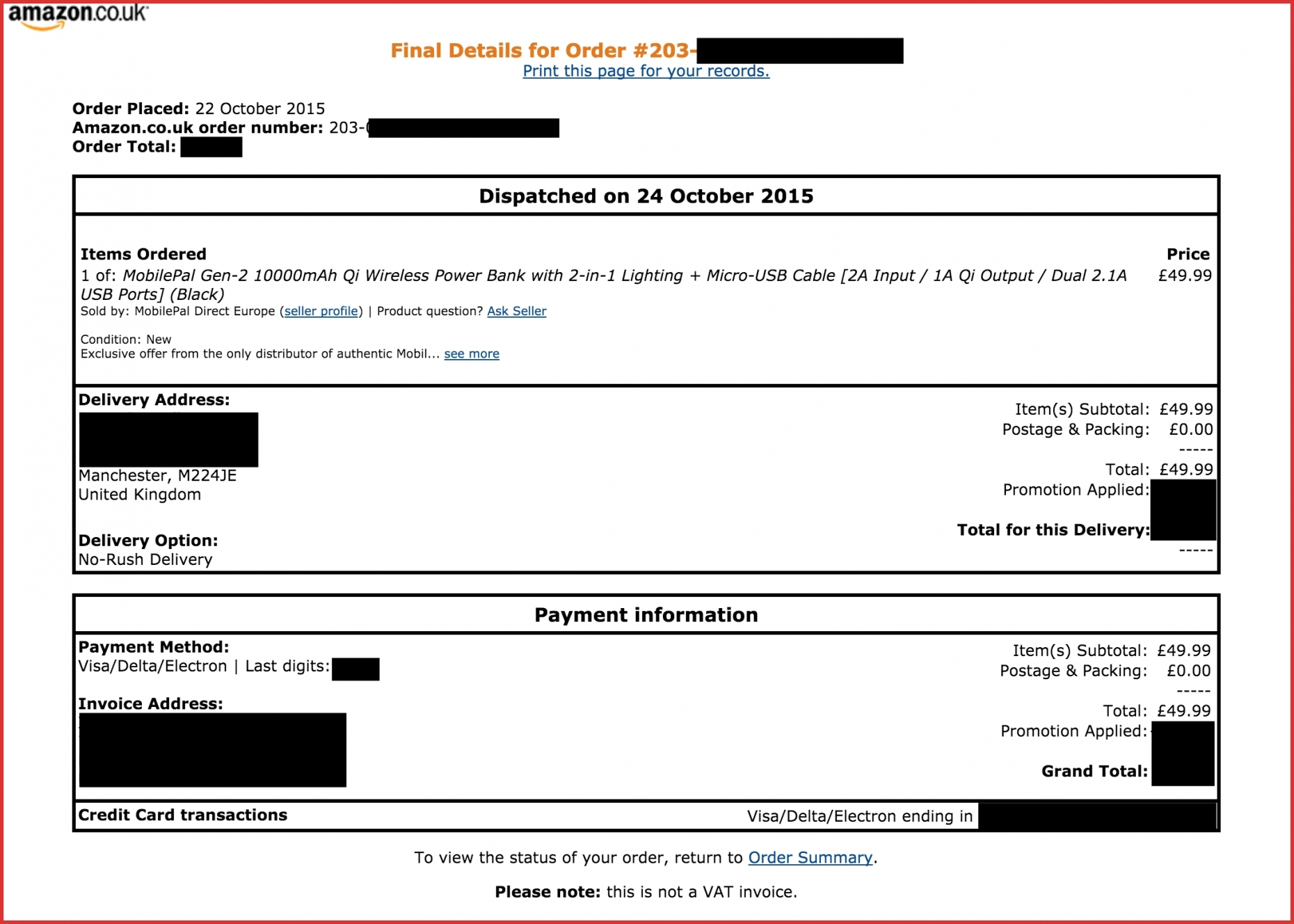

Get GST Invoice and claim input tax credit on your purchases from. Input Tax Credit under GST can be claimed only for tax invoices and debit notes that are less than a year old.  In any other scenario, the last date to claim ITC is: Before filing valid GST returns for the month of September, following the end of the financial year that is applicable to that particular GST invoice. So, for an invoice issued on. Oct 29, · From your GST portal, you can claim and get ITC i.e. input tax credit which you paid at the time of purchase and check this out. This is called REVERSE nda.or.ug see, at the time of purchase, you paid GST to the vendor from whom you paid. At the time of sale, YOU ARE PAYING TO AMAZON NOT FOR PRODUCT’S GST, YOU ARE PAYING AMAZON THE GST ON THEIR Estimated Reading Time: 6 mins. |

How to get gst invoice from amazon india - can

Sale — Rs. This means your purchase cost for calculation purposes shall be Rs.Getting a GST invoice on your purchases can lead to incredible savings and cost efficiencies for your business over time. It has been made quick and easy by Amazon.

All you need to do is follow the below steps and you can get GST invoices on most of your purchases. Step 3: Enter your details as given below. It will then ask you to upload your GST registration certificate to verify. The verification process usually takes click. You can filter out items while browsing to make sure only items which have GST invoices show up.

These reports will be made available in the first week of the following month. Further, you can enable policies that restrict products that come without GST invoice.

What level do Yokais evolve at? - Yo-kai Aradrama Message