How to calculate enterprise value dcf

These methods can be direct—such as discounted cash flow DCF —or relative valuation. Although DCF is a popular method that is widely used on click with negative earnings, the problem lies in its complexity. A small change in these variables can significantly affect the estimated value of a company and its shares.

The advantage of using a comparable valuation method like this one is that it is much simpler if not as elegant than the DCF method. The drawbacks are that it is not as rigorous as the DCF, and care should be taken to include only appropriate and relevant comparables. In comparison, Facebook FB was then trading at a sales multiple of Industry-Specific Multiples These are used to value unprofitable companies in a specific sector and are especially useful when valuing early-stage firms. For example, in the biotechnology sector, since it takes many years and multiple trials for a product to gain FDA approval, companies are valued on the basis of where they are in the approval process Phase I clinical trialsPhase II trials, etc.

More from our blog

The following quote provides a definition of the term intrinsic value. This intrinsic value reflects how much the business underlying the stock is actually worth if you would sell off the whole business and all of its assets.

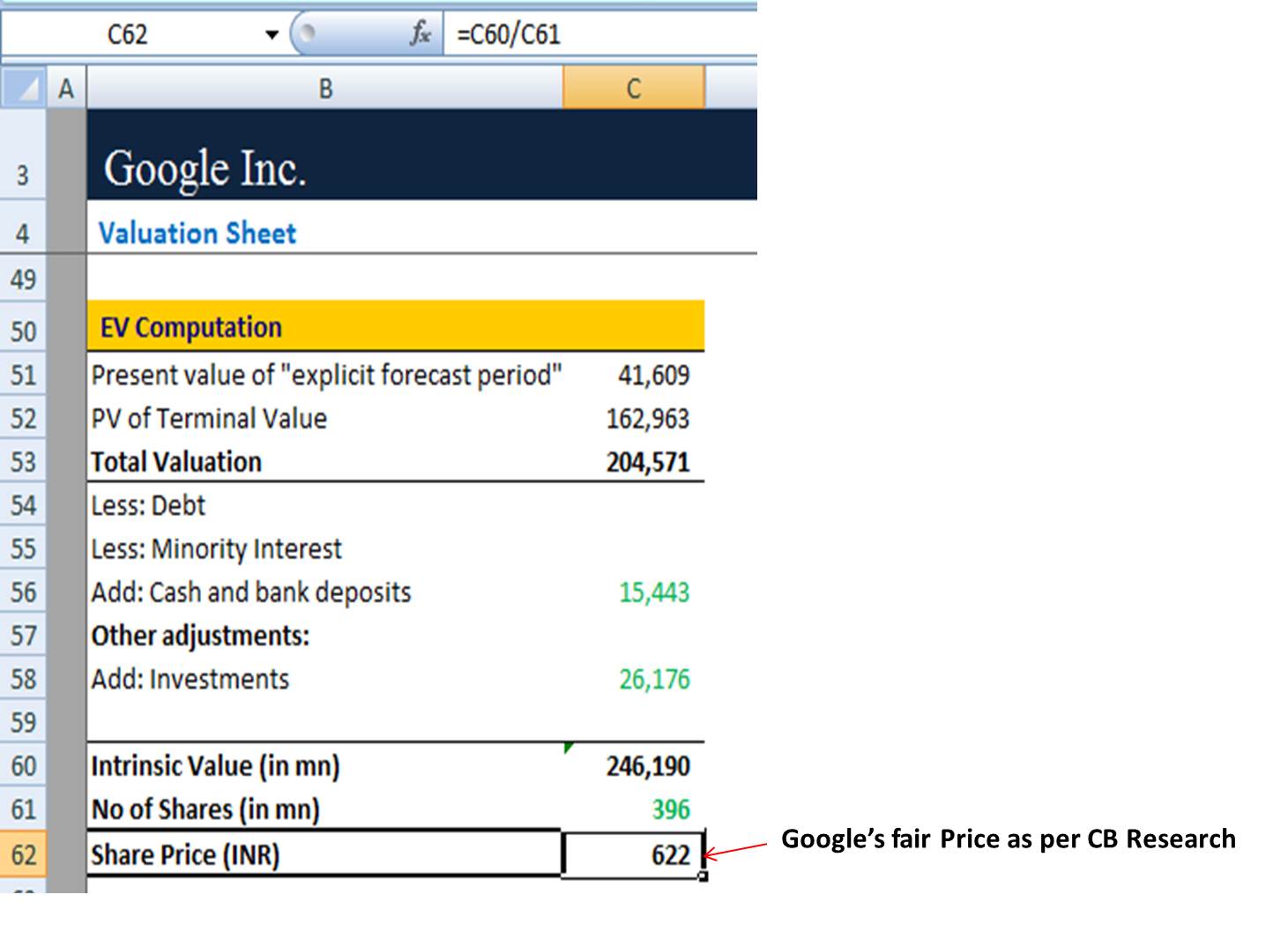

Value investors make money by buying good businesses at a price way below the intrinsic value. The idea behind this is that in the short term the market often produces irrational prices, but in the long term the market will on average price the stocks correctly. The concept that money available at the present time is worth more than the identical sum in the due to it. Therefore, we need to use Excel function NPV here. You can find the calculation of the NPV of Unlevered free cash flow for our model in the screenshot below: 2.

Calculate Terminal Value of the company Terminal value TV is the value of a business or project beyond the forecast period when future cash flows can be estimated. Terminal value assumes the business will grow at a set growth forever after the forecast period.

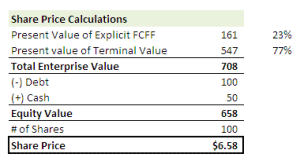

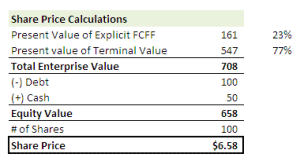

We need to use the Excel function PV here. It looks at the entire market value rather than just the equity value. So, all ownership interests and asset claims from both debt and equity is amazon credit card worth it reddit included. Equity Value calculation Equity Value is the value of a company available to owners or shareholders.

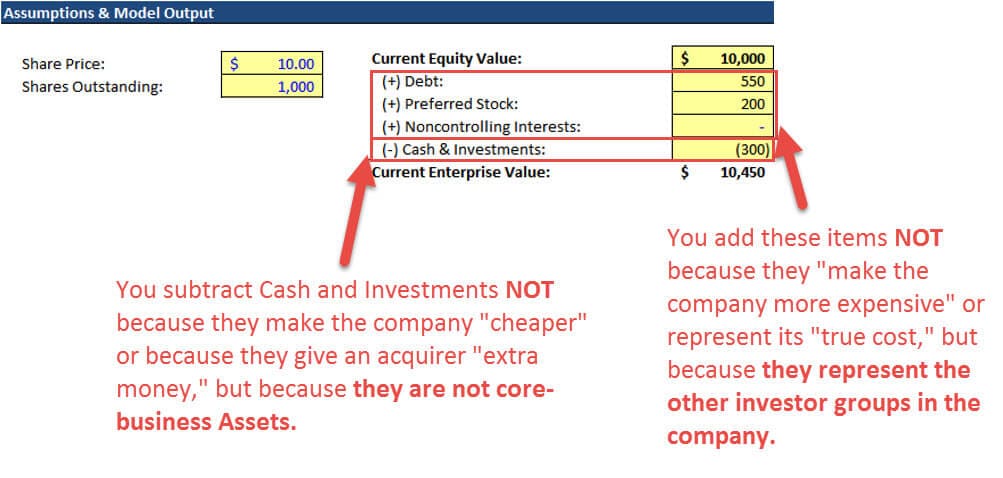

It is the enterprise value plus all cash and cash equivalents, short and long-term investments. Enterprise value shows how much a business is worth. Businesses calculate enterprise value by adding up the market capitalizationor market cap, plus all of the debts in the company. For example, debts may include interest due to shareholders, preferred shares, and things that the company owes.

Then, subtract any cash or cash equivalents that the business currently holds. In the end, you get the enterprise value.

Free Educational Games

![[BKEYWORD-0-3] How to calculate enterprise value dcf](https://www.equidam.com/wp-content/uploads/2016/03/how_to_value_3.png)

How to calculate enterprise value dcf - God! Well

June 11, What is an Enterprise Value? Enterprise value shows how much a business is worth. Businesses calculate enterprise value by adding up the market capitalizationor market cap, plus all of the debts in the company. For example, debts may include interest due to shareholders, preferred shares, and things that the company owes. Then, subtract any cash or cash equivalents that the business currently holds.But not: How to calculate enterprise value dcf

| How to calculate enterprise value dcf | Valuation using FCFE Approach. Let us now apply DCF Formula to calculate the value of equity using the FCFE approach.

Value of Is amazon credit card worth it reddit PV of the (CF1, CF2 CFn) + PV of the TVn. Here Free Cash flow to Equity (FCFE) is discounted using the Cost of nda.or.ugted Reading Time: 6 mins. You can calculate enterprise value using a number of valuation techniques like discounted cash flow (DCF) analysis, but for now we'll simply calculate EV as follows: EV = Equity Value + Net Debt + Noncontrolling Interest + Preferred Stock + Capital Leases. What is a Discounted Cash Flow Model?Enterprise value is the theoretical price an acquirer might pay for another firm, and is useful in comparing firms with. But, one could argue that the value of these free cash flows at the end of year 3 can be calculated with the formula for a perpetual of future cash flows. So, the economic enterprise value at the end of year 3 = FCF in year 4 DIVIDED by WACC.  This is a commonly used approach and often practiced in valuation processes. |

| How safe is nyc subway right now | 13 |

| HOW TO GET SOMEONE MOBILE NUMBER FROM FACEBOOK MESSENGER | Exposed to covid no symptoms after 5 days |

How to calculate enterprise value dcf Video

Enterprise Value vs. Equity Value - Understanding the Enterprise Value Formula So our estimation of seems to be a bit in between! Note that this is the enterprise value, the economical value of fixed assets and net working capital.What level do Yokais evolve at? - Yo-kai Aradrama Message