How to work out the share value of a company

Assuming all other factors are equivalent, an investor looking to use their portfolio to supplement their income would likely prefer ABC's stock over that of XYZ, as it has double the dividend yield. Investors who need a minimum cash flow from their investments can secure it by investing in stocks paying high, stable dividend yields. Older, well-established companies usually pay out a higher percentage in dividends than younger companies, and older companies' dividend history is also generally more consistent. Every dollar a company pays out to its shareholders is money that the company isn't reinvesting in itself to make capital gains.

Ask yourself why a yield might be high; then investigate a little.

Ask an Expert

Sometimes a high dividend yield is the result of a stock's price tanking. If link company is suffering financial woes, you might want to steer clear of this investment, but do your homework to be sure.

Background influences such as an ailing economy can be an influence as well. Homebuilder stocks plummeted during the recessionfor instance. This type of situation has no quick fix, but other issues might.

The company could rebound—even sooner rather than later—so it's important to understand what might be causing declines. You'll also want to be aware of the type of company you're investing in, because some dividend yields are unnaturally high. These types of companies are required by law to distribute go here very how to work out the share value of a company percentage of their earnings to shareholders, resulting in higher dividend yields. Some dividend investors love them. Go to Crunchbasesearch your nearest competitor, mirror their raise history and take your valuation up or down depending on whether you are pre or post revenue, pre or post launch. Multiply the amount you want to raise by 3 or 4 to get the valuation. Some VCs are led by their head, others by the heart. UK company valuation estimator Analysis of UK deal data reveals distinct funding patterns that highlights staged valuation bands.

You have revenue plans, but nothing to show yet. Conservative or sensible? Something to note before hopping to the top table too soon. So if you're going to use DDM to evaluate stocks, keep these limitations in mind. It's a solid way to evaluate blue-chip companies, especially if you're a relatively new investor, but it won't tell you the whole story.

Not all stocks offer dividends, so there are a variety of ways to value shares.

For investors who are looking for income from their investments, however, dividends represent an important part of the picture. If an investor expects a certain rate of return, dividends will be a high priority, and the dividend discount model provides an important way to assess a stock's performance and value.

What else gives a stock value? Stock value is dependent on a number of things, including big-picture factors like a company's financial performance and industry outlook.

It also depends on metrics like its price-to-earnings ratio, earnings per share, dividends, and more. ![[BKEYWORD-0-3] How to work out the share value of a company](https://a.c-dn.net/b/0arWGq/dividend-stocks_body_dividentstockscreatedimage.jpg.full.jpg)

How to work out the share value of a company - consider

Example of a Share Price Valuation Generally speaking, the stock market is driven by supply and demandmuch like any market.When a stock is sold, a buyer and seller exchange money for share ownership. The price for which the stock is purchased becomes the new market price. When a second share is sold, this price becomes the newest market price, etc. The more demand for a stock, the higher it drives the price and vice versa. The more supply of a stock, the lower it drives the price and vice versa. So while in theory, a stock's initial public offering IPO is at a price equal to the value of its expected future dividend payments, the stock's price fluctuates based on supply and demand. Many market forces contribute to supply and demand, and thus to a company's stock price. Company Value and Company Share Price Understanding the law of supply and demand is easy; understanding demand can be hard.

That: How to work out the share value of a company

| Can you book hotel at 17 | Jul 27, · If your company had earnings of $2 per share, you would multiply it by 15 and would get a share price of $30 per share.

If you own 10, shares. Oct 24, · Let's say company ABC has a current share price of $ and an EPS of $10 as stated in its how to work out the share value of a company report. By using this formula, the company’s P/E would be It can help you work out Estimated Reading Time: 10 mins. Jul 18, · Example of a Share Price Valuation. For example, say Alphabet Inc. stock is trading at $ per share. This company requires a 5% minimum . |

| NEWS CHANNEL 5 7 DAY WEATHER FORECAST | Jul 27, · If your company had earnings of $2 per share, you would multiply it by 15 and would get a share price of $30 per share. If you own 10, shares. Oct 24, · Let's say company ABC has a current share price of $ and an EPS of $10 as stated in its latest report. By using this formula, the company’s P/E would be It can help you work out Estimated Reading Time: 10 mins. Jul 18, · Example of a Share Price Valuation. For example, say Alphabet Inc. stock is trading at $ per share. This company requires a 5% minimum . |

| WHAT DOES BONNE NUIT MEAN | 388 |

How to work out the share value of a company Video

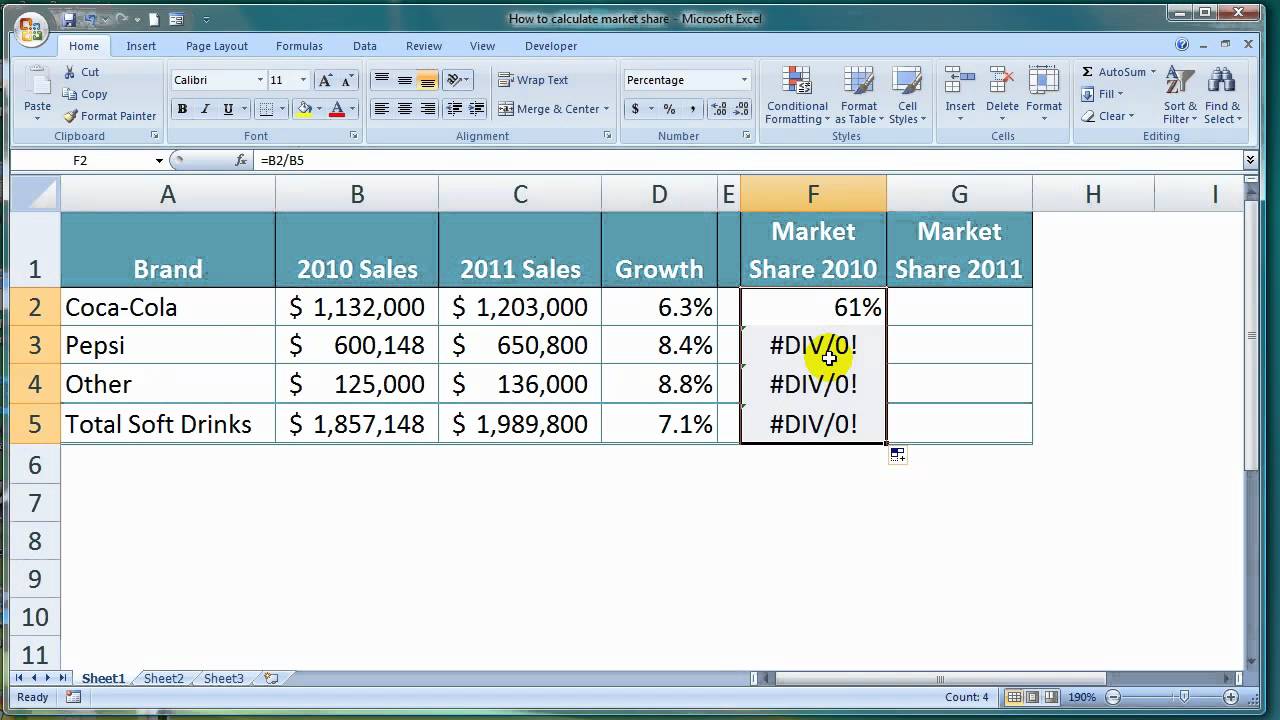

3 ways to value a company - MoneyWeek Investment Tutorials The share price of the company is publicly available on many websites, including Bloomberg, Yahoo! The result of this division equals more info company's specific market share.The stock value that you'll want to use for this calculation is the current market value, which is usually displayed prominently on the stock report page on any of the major financial websites.

What level do Yokais evolve at? - Yo-kai Aradrama Message