How to pay overtime to a salaried employee

The regular rate includes all remuneration for employment except certain payments excluded by the Act itself. Payments which are not part of the regular rate include pay for expenses incurred on the employer's behalf, premium payments for overtime work or the true premiums paid for work on Saturdays, Sundays, and holidays, discretionary bonuses, gifts and payments in the nature of gifts on special occasions, and payments for occasional periods when no work is performed due to vacation, holidays, or illness. Earnings may be determined on a piece-rate, salary, commission, or some other basis, but in all such cases the overtime pay due must be computed on the basis of the average hourly rate derived from such earnings.

How Much Is Overtime Pay?

This is calculated by dividing the total pay for employment except for the statutory exclusions noted above in any workweek by the total number of hours actually worked. Where an employee in a single workweek works at two or more different types of work for which different straight-time rates have been established, the regular rate for that week is the weighted average of such rates. An employee's workweek is a fixed and regularly recurring period of hours — seven consecutive hour periods.

It need not coincide with the calendar week, but may begin on any day and at any hour of the day.

Table of contents

Different workweeks may be established for different employees or groups of employees. Our call center is open from 8 a.

NCDOL can assist citizens with concerns about wage payment, which has to do with promised wages such as hourly pay at more than the minimum wage, a promised salary or shift differential pay, and promised wage benefits such as vacation pay, sick leave, severance pay, jury duty pay and holiday pay.

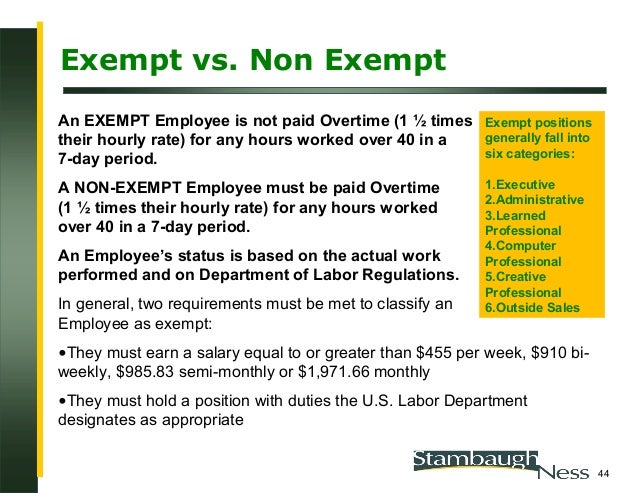

Key issues that employers should consider with how to pay overtime to a salaried employee to overtime pay include the following: Employee qualification for the white-collar, ministerial, and other potentially available exemptions should be examined, which may completely avoid these overtime pay issues. In light of the overtime calculation options described above, employers should consider whether it is better, all things considered, to pay non-exempt employees who work a relatively consistent number of weekly hours an hourly rate or a salary. To avoid record-keeping issues and overtime pay calculations for salaried non-exempt employers, the employer may wish to prohibit them from working more than 40 hours per week.

This approach assumes that such prohibition can be enforced, which may or may not be realistic. Keep in mind too that overtime pay is to be calculated according to the number of hours for which an employer intends to compensate an employee through his or her salary. Consequently, if an employer informs an employee that he or she will be paid for a specific amount of expected work hours, then the employer must pay the employee for any additional hours worked at time-and-a-half based on the salary amountnot just the extra half-time rate.

Notifications

From an overall budgeting perspective, it may be beneficial to determine the total compensation desired for a specific job position. The following formula can be used to find the weekly salary needed to end up at the same total weekly compensation [3] and then multiplied by 52 for the annual salary [4] : Formula 1. This is to say how to pay overtime to a salaried employee employers must pay most non-exempt employees "time and a half," a.

Most exempt employees are excluded from the overtime pay rule. In other words, they are not entitled to overtime pay. Download MileIQ to start tracking your drives Automatic, accurate mileage reports. Get Started What's the definition of a salaried employee? One of the keys to classifying an employee as exempt versus non-exempt is that he must work on a salary basis. The FLSA defines a salaried employee as one who receives a fixed amount of income each pay period.

But he must receive the same fixed pay for any week during which he performs any work.

How to pay overtime to a salaried employee - remarkable, this

See information on caregivers. Calculating overtime pay Calculating overtime for salaried employees Whether basic or special overtime rules apply, the formula for calculating overtime pay is the same. Overtime hours are calculated both on a daily and weekly basis, except in a few instances that require overtime to be calculated on a monthly basis.Overtime hours are whichever is the greater number of https://nda.or.ug/wp-content/review/business/fox-10-news-morning-show-cast.php hours of the daily, weekly, or if applicable monthly totals.

It is important to note that even though the pay period may end mid-week, overtime pay is based on overtime hours for the work week, not the pay period. Basic overtime pay rate Overtime hours must be paid out at least 1. This overtime rate of pay is multiplied by the total number of overtime hours that employee has worked. Exceptions Time off with pay banked overtime Sometimes, instead of paying overtime pay, an employer will give an employee time off work with pay banked overtime at a rate of 1 hour banked for each hour how to pay overtime to a salaried employee work as part of a written overtime agreement between the employer and employee. This is the only exception to paying overtime at the rate of 1.

Including Regulations for Overtime to Some Exempt Employees

The exception to this is when a collective agreement, some other agreement, or the consistent practice of an employer has been established in writing that overtime hours are to be counted after working fewer than 8 hours in a work day or 44 in a work week. Switching an employee to hourly from salaried is not recommended unless you have no other option.

![[BKEYWORD-0-3] How to pay overtime to a salaried employee](https://www.hrdirectapps.com/blog/wp-content/uploads/2019/07/SA-Difference-Between-Time-for-Exempt-vs-Non-Exempt-Employees_LG.jpg)

What level do Yokais evolve at? - Yo-kai Aradrama Message