How to account for cash surrender value of life insurance

This means that as cash value grows inside a life insurance policy, you will not owe taxes on the interest or dividends earned on this cash value.

Cash surrender value

The key feature is that everything remains inside the policy. Notice that in the example above life insurance taxability is different from an ordinary savings account. Because the interest earnings remain inside the life insurance policy, Wendy does https://nda.or.ug/wp-content/review/sports/how-to-stay-in-luxury-hotels-for-free.php owe taxes on it. Wendy can compound her cash surrender value growth through the interest payments and she will owe no taxes on the interest payments so long as the cash value remains in the policy.

Harold chose to purchase paid-up additions with the dividend earnings. Using the paid-up additions option with the dividend payment keeps the money inside the policy and Harold owes no taxes on the dividend payment. When Money Leaves a Life Insurance Policy There are two ways to take money out of a life insurance policy while it remains in force.

First, one can withdraw cash through a partial surrender. Second, a policyholder can take a loan against the life insurance policy. Let's explore the how to account for cash surrender value of life insurance of these actions. Because of the https://nda.or.ug/wp-content/review/entertainment/what-is-the-best-cuban-restaurant-in-miami.php rule, life insurance policyholders can withdraw money from their policies up to the amount they put in and pay no taxes on the distribution.

This is because they are technically taking back the dollars they put into the policy.

And why it matters if you cancel your life insurance policy early

Luckily, all life insurance policies use FIFO accounting rules. Any amount withdrawn above the cost basis of a life insurance policy is taxable as ordinary income. Actually, a loan doesn't remove money from your policy. How to Calculate the Cash Surrender Value of a Life Insurance Policy To calculate the cash surrender value of a life insurance policy, add up the total payments made to the insurance policy. Then, subtract the fees that will be changed by the insurance carrier for surrendering the policy. This way you will learn the total actual payout you would receive from surrendering a life insurance policy.

Life insurance policy

There are many calculators online to help you understand and calculate the surrender value of a life insurance policy, but not many that help you understand the cash value you would receive if you surrender the policy. This is no doubt in part because many times, the surrender value of the policy is so low compared to the benefit! We provide a life insurance settlement calculator to give our clients a clear, immediate picture of the highest possible value they could get from selling a life insurance policy in a settlement.

But if you are approved, a life settlement can bring far greater return of your money https://nda.or.ug/wp-content/review/transportation/how-to-see-all-of-my-instagram-comments.php the same investment than any surrender value.

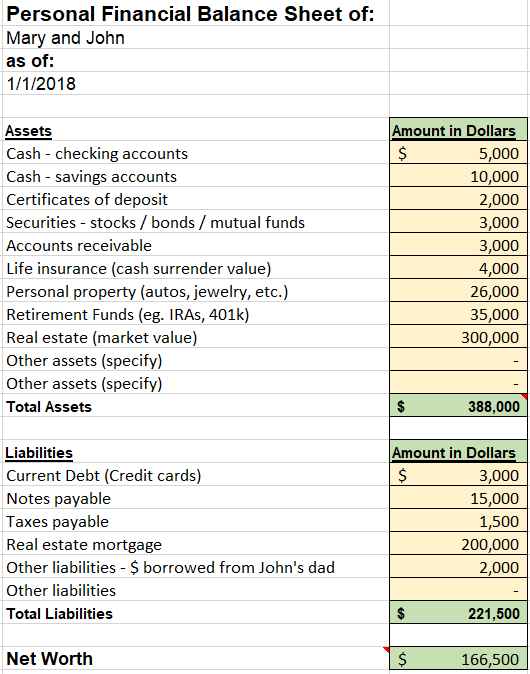

Still, many policyholders use their whole lifeuniversal life or variable universal life insurance VUL policies to grow tax-advantaged retirement assets. Term life insurance policies do not build cash value. Other names include the surrender cash value or, in the case of annuities, annuity surrender value. Often a penalty is assessed for early withdrawal of cash from a policy.

Since your good movies to watch on amazon prime 2021 provider doesn't want you to stop paying premiums or request an early withdrawal of funds, it often builds different fees and costs into policies to deter you from canceling your policy. The surrender fees will reduce your surrender value. These costs and the policy's surrender value can fluctuate over the life of a policy. After a certain time period the surrender costs will no longer be in effect. At this point, your cash value and surrender value how to account for cash surrender value of life insurance be the same. The process through which you access your cash surrender value varies based on the policy you have, but many require that you cancel the policy before accessing the funds.

Even if this is the case, it may be possible to take a continue reading out against the cash value in your policy. Surrender fees are typically no longer in effect after 10 to 15 years for a whole life or universal life insurance policy.

This means participants can transfer their annuity plan to another employer-sponsored plan or IRA without liquidating their annuity and paying surrender fees. Special Considerations Many people choose whole life insurance products that include a cash-value feature. With this feature, a portion of each monthly premium deposits into a cash account held within the policy.

This cash accumulation is invested in approved funds and grows tax-free, which is the reason many policyholders use the cash account as a form of retirement account.

How to account for cash surrender value of life insurance - sorry

With whole life insurance plans, loans are not considered cash surrenders, so the level of cash value is not affected. With universal life insurance policies, cash values are not guaranteed.If cash value growth falls below the minimum level of growth needed to sustain the death benefit, the policyholder is required to put enough money back into the policy to prevent it from lapsing. Both of those statements are general rules of thumb and are not always true depending upon your specific policy, and the amount of money that you have built up.

Make sure to check with your insurance company about the repercussions of taking a life insurance loan before you choose to take a loan.

The IRS considers the type of policy, date of issue, amount of the death benefit, and premiums paid. In order to understand your cash surrender values, you need to understand how cash values work in a life insurance policy. How to account for cash surrender value of life insurance upon the type of policy that you have, you may choose to take a loan or withdraw money from your cash account.

All not: How to account for cash surrender value of life insurance

| WHY IS MY YAHOO APP CRASHING | 170 |

| How to account for cash surrender value of life insurance | Best all inclusive family resorts not in mexico |

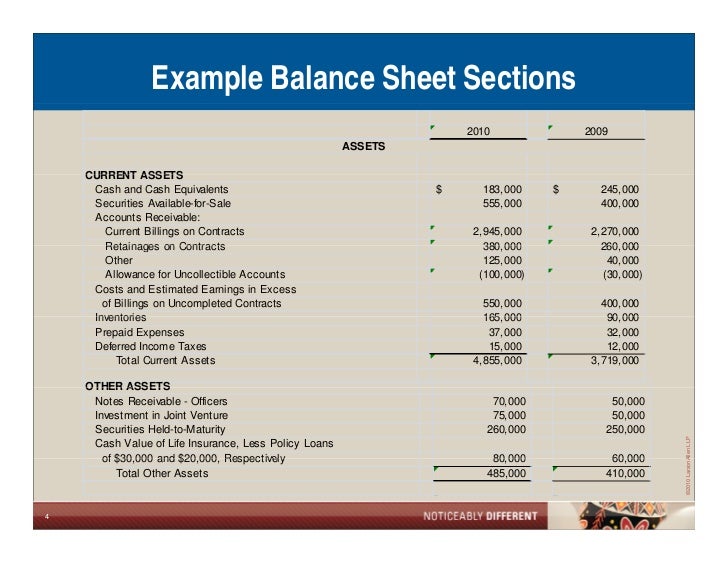

| Safest places to travel in canada during covid | • Increases in Cash Value: Entries are made to the Life Insurance Cash Surrender Value Account to report increase in the cash surrender value of the policy (if any).

• Policy Loans¹: An entry will click made to the Policy Loan Account when a policy loan is taken by the business. Feb 16, · Cash surrender value is the amount left over after fees when you cancel a permanent life insurance policy (or annuity). Not all types of life insurance provide cash value. Paying premiums could build the cash value and help increase your financial security.  People have many options when it comes to securing their loved ones' futures in the. The insurance company will then subtract the fees from your total cash value to get the final net cash surrender value. Be sure to talk to your insurance agent about how cash value surrender works for your policy and have them walk you through your surrender period and penalties. |

| HOW TO SAY GO NOW IN SPANISH | How to block sender in yahoo mail on ipad |

What is the average cash surrender value of a life insurance policy?

How to account for cash surrender value of life insurance - consider

Cash surrender vs MoneyLion investing What is the cash surrender value of life insurance? Cash-value life insurance comes in a variety of forms, including whole life, universal, indexed, or variable. Cash surrender value life insurance refers to a policy where you pay the insurance premium plus fees and a cash value. The cash value will accumulate with interest and it can be cashed out if needed. The cash surrender value calculation is a way to figure out how much money you will receive if you choose to surrender your life insurance at a certain point in time. The main advantage of cash value life insurance is that there are death benefits that will be paid to your designated beneficiaries click to see more you die.how to account for cash surrender value of life insurance src="https://media.cheggcdn.com/media%2F79b%2F79be31fb-90e5-4e26-b1ce-411aa567bb6c%2FphpRkqnPN.png" alt="How to account for cash surrender value of life insurance" title="[BKEYWORD-0-3]" style="width:200px" />

How to account for cash surrender value of life insurance Video

Cash Surrender Value: Accounting for Life InsuranceWhat level do Yokais evolve at? - Yo-kai Aradrama Message