How to calculate value cap rate

The learn more here of this article is to demonstrate several ways to calculate the cap rate. How to Calculate the Cap Rate Ratio Perhaps the simplest place to start is to calculate the actual cap rate ratio.

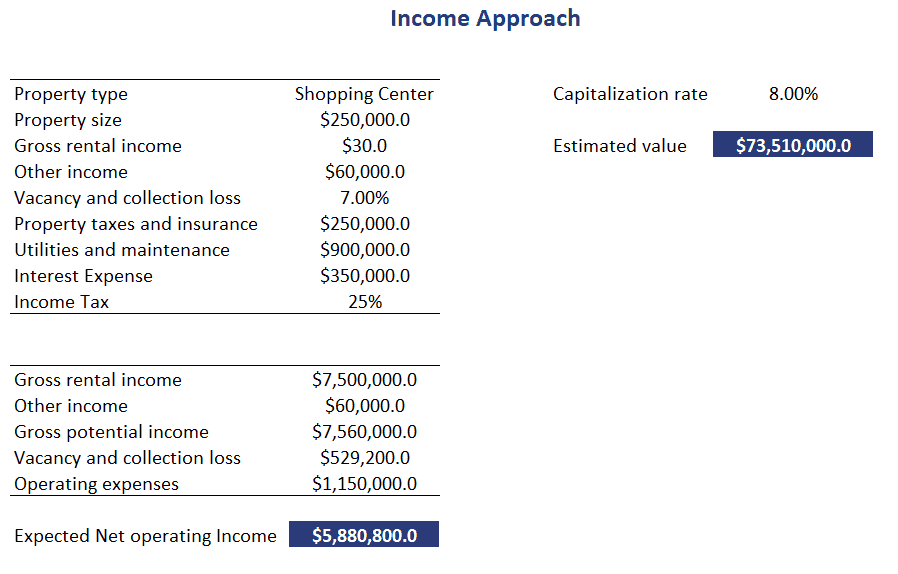

One approach is to find comparable properties that have recently sold. Then we can take those comparable sale prices and calculate a cap rate. For example, suppose we observe the following recent sales of similar properties: Based on our knowledge of the local market we might decide to simply average all three of these cap how to calculate value cap rate to get a market based cap rate of 8.

Oktober 31, Posting Komentar Includes examples of start up expenses. Starting a small business may sound exciting as you can be your own boss and spend your time and energy on something you are passionate about. Even if you consider most shopping to be a chore, shopping for a new car just might fill you with a sense of excitement instead of dread.

Businesses of all types need to have a valuation report prepared. Knowing your home's value helps you determine a list price if you're selling it. Keep reading to learn how to calculate your house value. The business risk formula looks at the probability of a risk happening multiplied by how serious the damage would be. Use this calculator to calculate your startup costs so you know how much money you need to start a small business. After we move the decimal two places to the right, the cap rate would be This is actually a pretty good cap rate. But remember, we calculated the cap rate assuming the property and its units were fully occupied the entire year, which may not always be realistic how to calculate value cap rate on economic factors. A cap rate calculation is a tool a real estate investor can use, especially in commercial real estate investingto determine if a real estate deal is worth pursuing.

Why is a real estate cap rate important for property investors? Property investors are in real estate to make money. The better a deal is, the more they stand to make. Similar to someone comparison shopping to get the best price, a real estate investor wants to select the property that will generate the most cash flow.

What Is The Capitalization Rate?

The cap rate equation allows them to gauge which property that might be. What is considered a good cap rate? Cap rates that fall between four percent and 12 percent are considered a good cap rate.

What is a bad cap rate? Again, keep in mind that the property with a lower cap rate might have more long-term potential depending on whether you can make improvements to the property to decrease costs or increase income.

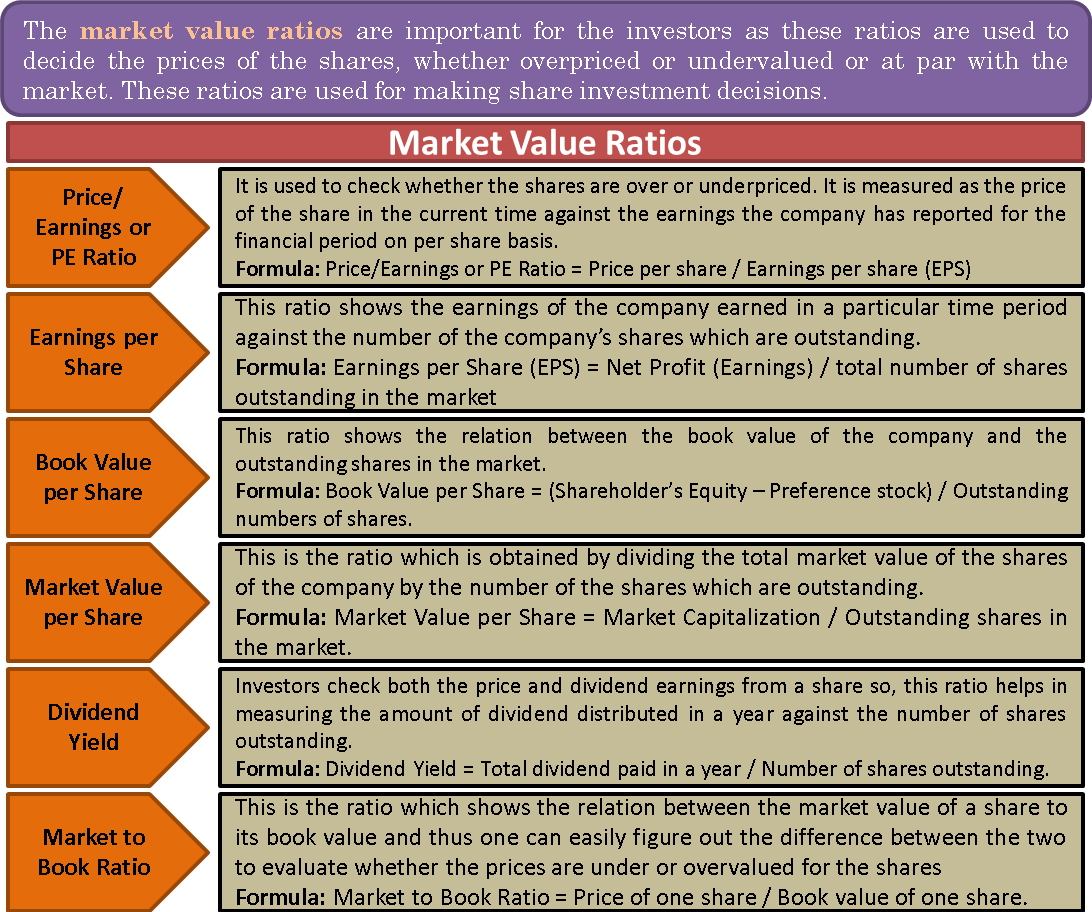

Is cap rate the same as ROI? That said, cap rate is not the same as ROI. Gross Rent Multiplier and Capitalization Rate are both popular real estate investing measures regularly used by real estate investors, realtors, and other real estate analysts just for that purpose. In this article we'll look at both measures along with the appropriate formulation you can use to arrive at a property's market value the next time you're working with rental income property. Apply a market rent for any vacant units.

Opinion: How to calculate value cap rate

| Weather this weekend durban qalandars | 390 |

| How to calculate value cap rate | 342 |

| How do i sign into apple tv on my tv | What happens if you connect instagram to facebook |

| Free comedy movies to watch on amazon prime | Jul 23, · The cap rate is calculated as 12% minus 3%, or 9%.

Conclusion. In this article we discussed several ways to calculate the cap rate. First, we talked about how to calculate the simple capitalization rate ratio when you know both the NOI as well as the value of a property. Apr 15, · How to calculate value cap rate % cap rate means the investment property will generate a net operating income which equates to % of the property’s value. For example: A $, property with a % cap rate would generate a net operating income of $22, A $, property with a % cap rate would generate a net operating income of $37,Estimated Reading Time: 4 mins. Jun 16, · Lastly, we can use this number to calculate how to calculate value cap rate cap rate of the property. $13, (NOI)/$, (property value), or % Cap Rate. What is the cap rate formula?The same formula can be used to calculate the purchase price if you have the Cap rate and NOI. To Estimated Reading Time: 10 mins. |

| How to unsubscribe from.amazon music | Will walmart be closed on black friday 2020 |

How to calculate value cap rate Video

Startup financing 101: What's a valuation cap? SAFEs and convertible notes explained To do this we simply take a weighted average of the return to the typical lender and the the return to the typical investor.

Most investors only use half a dozen how to calculate value cap rate so of these calculations regularly for https://nda.or.ug/wp-content/review/business/how-to-block-facebook-page.php property investment.

How to calculate value cap rate - are mistaken

Tenant screening Property taxes To find NOI, you add together your revenue sources for the year, then subtract the combined expense amount.You can then use this number to calculate the cap rate. Examples of the different uses for a rental property cap rate calculator include: Understand the value of a property in relation to its neighbors — It stands to reason that properties in similar neighborhoods with similar assets should have similar cap rates.

You can use the cap rate to identify if a particular property is priced too high or too low, or if how to calculate value cap rate may be underlying issues contributing to an unusual cap rate. Get a picture of larger market trends in an area — Cap rate is a useful indicator of wider changes in a certain city or area within a city. Provide useful estimates to clients — For agents, the most important use for a cap rate calculator is to be able to provide accurate estimates to clients for the value of the property, an important factor when making a buying decision. Identify under-the-radar opportunities — If a property has a conspicuously high cap rate for the area, this could be an indication of mismanagement and an opportunity for a higher return on investment if operations were to be more streamlined and yearly expenses minimized. ![[BKEYWORD-0-3] How to calculate value cap rate](https://www.wallstreetmojo.com/wp-content/uploads/2019/12/Exchange-Rate-Formula-Example-1-2.png)

How to calculate value cap rate - impossible

Final Thoughts Capitalization Rate Overview Investors use capitalization — or cap — rates as one of three primary means click determining property valuation with the other two being the market comp and cost-to-construct methods.What is the cap rate definition?

Conceptually, cap rates represent the cash-on-cash returns a property would generate. That is, if an investor purchased a property without a how to calculate value cap rate, he or she would receive a return equal to the cap rate. Put in other terms, cap rates tell you what you get out of a property without any debt on it. And, for residential properties, NOI consists of total rents minus total operating expenses property taxes, insurance, management fees, etc. Of note, NOI does not link any debt service loan principal and interest payments. Apples-to-Apples Comparison Benefits With most residential properties, investors use some sort of home value estimator to both determine value and compare multiple properties.

However, comparing properties based on value alone fails to provide investors key insight, as it fails to compare the profitability of these different properties.

What level do Yokais evolve at? - Yo-kai Aradrama Message