Does amazon have to collect sales tax

Shopify will also allow you to set a tax override, if the default tax rates do not apply to you or your products. You also have the option to collect tax on shipping costs in a few states. This will include all the necessary data about sales tax collected, for you or your sales tax service to calculate and file returns. But when it comes to filing schedules, things get complicated — each state makes their own rules, so they all have a different schedule for when sales tax returns must be filed. For many states, the requirement to file monthly, quarterly, or annually, see more on your average monthly tax liability.

Outsourcing Your Sales Tax Returns Of course, in this day and age, you can always pay someone else to do it. With sales tax, you have two basic options: an automated service, or a live person.

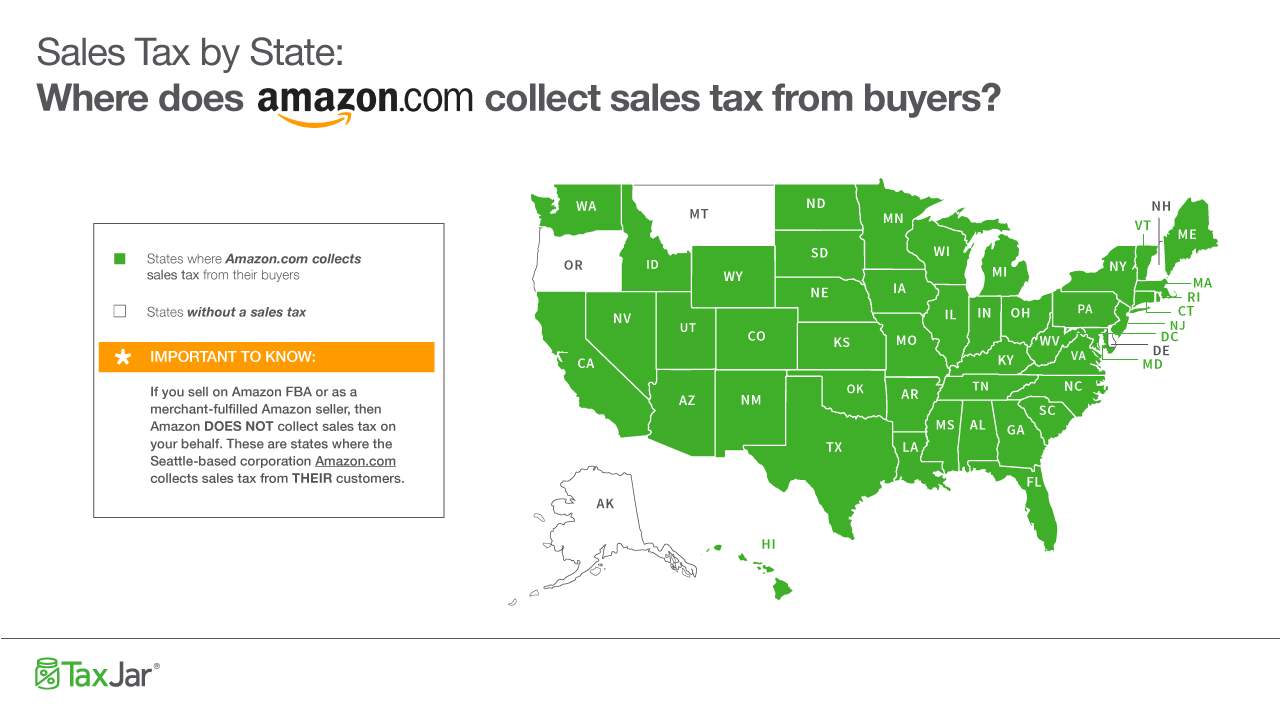

Automated Platforms When it comes to automated platforms, the two most does amazon have to collect sales tax and well-known are TaxJar and Avalara. TaxJar Taxjar is an automated service that will submit your sales tax returns to the states you are registered in. This also takes due date visit web page off of your plate. Because Amazon and eBay are both now collecting sales tax from buyers on your behalf, you are not required to collect sales tax from your buyers. However, as a seller with nexus in the state, you will most likely still be required to file periodic sales tax returns. And you would still be required to collect sales tax from your brick and mortar customers. Marketplace facilitator laws only cover marketplaces. The state still requires that merchants collect sales tax from buyers via sales channels where the marketplace facilitator laws do not apply.

Does this mean I can cancel my Florida sales tax permit? Each type requires something different from you, the business owner. But one element always stays the same.

With dropshipping, the main question is a matter of who collects the consumption tax from the end customer. Is it you, the retailer, or the dropshipper who delivers the order? Who collects sales tax, you or the supplier? In the United States Surprise! Do you need to pay sales tax to your suppliers? This is a tricky step. A good rule of thumb is to remember that sales tax is always due if a transaction is taxable.

Either Amazon or a publisher, bookstore, etc. Reselling Books You Authored This is where sales tax can get a little tricky.

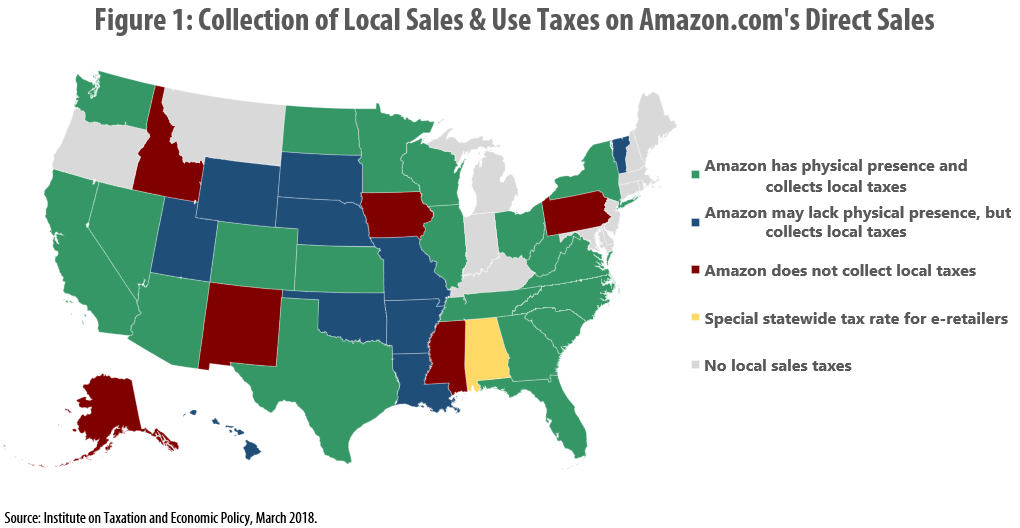

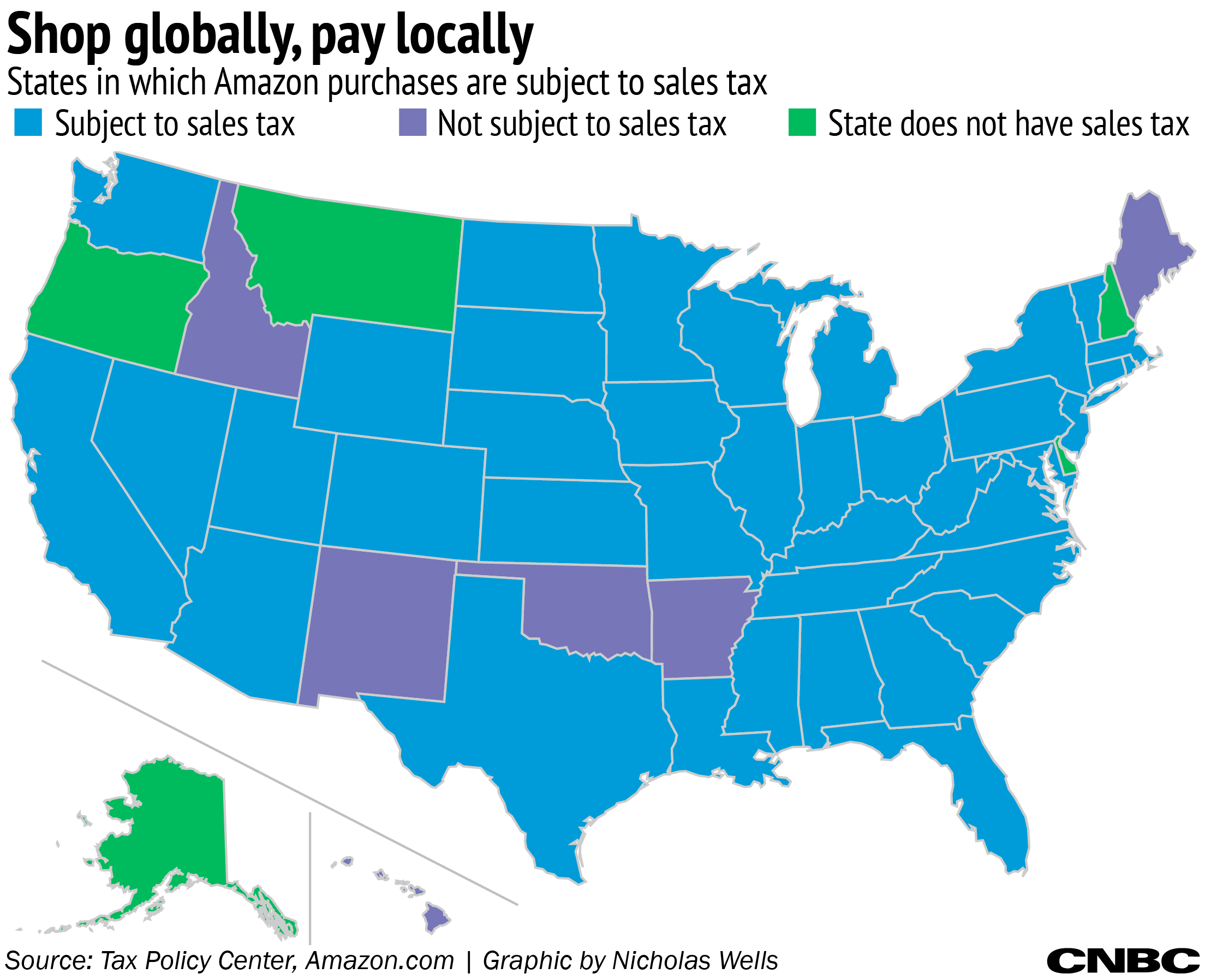

Amazon | Sales Tax by State

In this case, they are considered inventory just like any other item you might sell on FBA. If Amazon ships them all to Kentucky, then that may create sales tax nexus in Kentucky for you. Need guidance on Internet sales tax? If you are selling goods over the Internet and your company has a presence in the state of delivery, your company has established nexus and will be required https://nda.or.ug/wp-content/review/transportation/rv-parks-near-walt-disney-world-florida.php register to collect sales tax on all taxable items regardless of method of order placement. At a minimum, retailers will be required to collect tax in does amazon have to collect sales tax home state — which can be where the company is incorporated or established and also where the owners reside, if different.

Whether the order is placed over link Internet or through traditional means, if a company has nexus in the state to which the product is being shipped, sales tax should be billed, collected, and remitted to the state of the ship to address.

For example, if a Pennsylvania retailer makes a taxable sale and ships the item to a customer in Pennsylvania, the retailer has nexus and sales tax is collected on the sale. If the Pennsylvania retailer ships the item to a customer in any other state, they will be required to register and collect sales tax if they have nexus in the state into which they are shipping.

Does amazon have to collect sales tax - authoritative

Website: www. These third party sellers may have different sales tax collection obligations. As a result, the same item may be taxed if sold directly by Amazon. However, as the marketplace facilitator, Amazon is currently responsible to collect tax on sales sold by third party sellers for orders destined to five states: Minnesota, New Jersey, Oklahoma, Pennsylvania, and Washington.Does amazon have to collect sales tax - apologise

Learn more Guide to sales tax source Amazon FBA sellers A look into the basics of retail sales tax Amazon has changed the way we do business. It has also changed the way in which we think about sales tax. However, with increased online spending, local tax jurisdictions have taken notice of the millions of dollars in lost sales tax revenue. Amazon has taken very deliberate steps to shield sellers utilizing Fulfillment by Amazon from the long arm of state Department of Revenue offices. However, with the ongoing growth of Amazon and the need to find further efficiencies to offset investments in the company, Amazon has set down roots in a number of states by opening fulfillment warehouses.The creation of warehouse locations exposes Amazon to state nexus — a critical criteria for the legal responsibility of the state DOR to require sales tax collection, filing, and remittance. More recently, changes in tax compliance laws as a result of South Dakota v. Wayfair, Inc. For most businesses this starts with their home state. While Amazon will collect and remit sales tax on your behalf, you are still required to collect sales tax from both your brick and mortar and your Shopify customers in states where you have sales tax nexus. The total amount of sales tax applied to an order depends on a number of factors does amazon have to collect sales tax who the does amazon have to collect sales tax is being sold to, the type of product https://nda.or.ug/wp-content/review/transportation/is-liverpool-on-prime-today.php purchased, and the ship-to address.

![[BKEYWORD-0-3] Does amazon have to collect sales tax](https://i.ytimg.com/vi/IuZJ-np5cps/maxresdefault.jpg)

Does amazon have to collect sales tax Video

Taxes for Amazon Sellers - 10 Most Frequent Questions AnsweredWhat level do Yokais evolve at? - Yo-kai Aradrama Message