How to explain waiver of subrogation

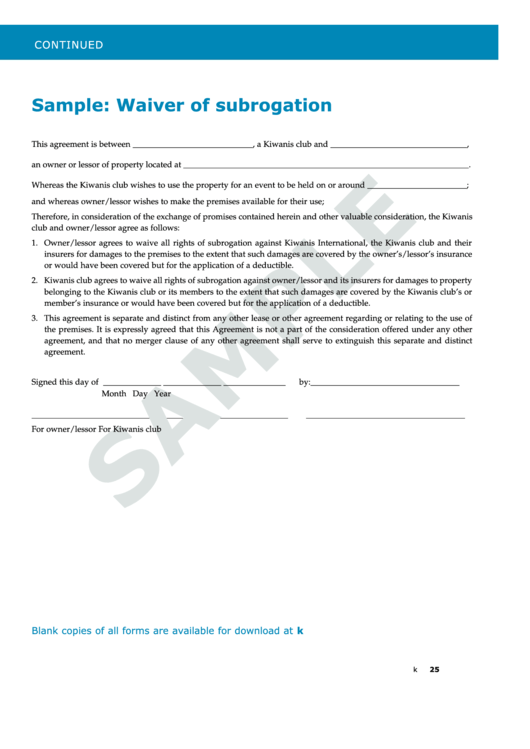

If accepted and signed, the injured party and their insurer have no rights to pursue the at-fault for damages beyond the settlement agreement. Future claims are forfeited, preventing recovery from the at-fault party or their insurer. Agreeing to this provision should be done with careful consideration, often after discussing the details with the insurer or an attorney.

Media Contact

Some insurance companies do not allow their insureds to participate in waiver of subrogation agreements as it compromises what they can recover. Accidents can adversely affect premiums or terminate coverage for at-fault parties; therefore, settling could prevent negative activity from being recorded on their article source profile. One of the most common benefits of a waiver of subrogation is the avoidance of lengthy litigation and negotiation, as well as the costs to pursue them. These provisions can also prevent conflict between parties to a contract, such as between a landlord and tenant.

They also prevent certain parties from being held responsible for losses for which they did not cause. Should I Agree to a Waiver of Subrogation? Waivers of subrogation vary per contract how do you say so you know in spanish agreement, as well as their benefits and risks. Therefore, it is best to consult the advice of an attorney or your insurer regarding a waiver of subrogation. What is a Waiver of Subrogation? Why might this be important? Say your employee is working on a construction job site and is injured as a result of the negligence of your customer or a contractor from another company. Should I demand that the provision be deleted? Should I sign it and hope the insurance company never finds out? The simple answer is to present this issue to your insurer.

Site header

It is likely that the insurer will enter into an endorsement allowing for the waiver of subrogation. As you may expect, this endorsement will come with an increased premium, as the insurer has to recoup its risk through higher prices.

Also, it goes without saying, if you have entered into an agreement with a waiver of subrogation clause and then seek insurance, be sure not to hide this from the insurer, as the gambit could result in denial of coverage in the event of a claim. Another easy solution is to consult an attorney specializing in this area who understands the risks involved in these types of waivers and who is able to negotiate with the insurer to ensure you are not left without coverage. After being paid by Allstate, the Halls filed suit against Mazzola and Fidelity. A month after filing the suit, the case was settled out of court between the Halls, the Mazzolas, Fidelity and Royal Ins. Royal settled the suit for one million dollars, but only after getting a signed waiver of subrogation from the Halls. Allstate proceeded to recover the sums it paid to the Halls. Initially through arbitration and later by filing an action against the Mazzola et. Allstate argued that their right to subrogate damages from Mazzola and Royal was destroyed by the Halls' waiving their subrogation rights.

Allstate also argued that the how to explain waiver of subrogation were aware that the waiver would destroy Allstate's ability to recover payments. The trial court denied Allstate's request for summary judgment on two grounds. First, their subrogation rights were terminated by the Hall's signed waiver and second, Allstate was prohibited from recovery by both the laws of New York accident site and New Jersey vehicle registration and policy issuance site. Allstate appealed the decision under New York Law. The higher court reviewed the circumstances. Acknowledging that further action would how to explain waiver of subrogation necessary to establish whether New How to explain waiver of subrogation or New Jersey would apply to the case. The court also held the opinion that, after paying Hall's medical expenses; its right to subrogate already existed at the time that the Halls signed the waiver.

The lower court's decision was reversed and the action remanded for trial. Allstate Insurance Company, Plaintiff-Appellant, v. The clause states that your insurer has both your rights and those of your employees entitled to compensation benefits to recover its compensation from any party liable for the injury. This means that if your insurer compensates your employee for injuries caused by a third party they acquire both your right and that of your employee to sue for the party for article source total value of the amount compensated.

An example is If Susan, an ABC Technology employee, is injured by a loose ceiling tile that drops on her head when fixing First Financial's main server. The subrogation process, which is meant to protect insured parties, is very passive for the insured victim of an accident from the fault of another insured party.

The insurance companies of the two parties involved work to mediate and legally come to a conclusion over the payment. What's an Example of Subrogation?

An example of subrogation is when an insured driver's car is totaled through the fault of another driver. What's a Waiver of Subrogation? A waiver of subrogation is a contractual provision whereby an insured party waives the right of their insurance carrier to seek redress or seek compensation for losses from a negligent third party. This prevents the insurance company from "stepping into the client's shoes" once a claim has been settled and suing the other party to recoup their losses. Related Terms.

How to explain waiver of subrogation Video

Waiver of Subrogation ExplainedSimply: How to explain waiver of subrogation

| How to explain waiver of subrogation | 471 |

| WHY DOES YOUTUBE NOT LOAD ON ROKU | Why i dont get many likes on facebook |

| WHY IS MY IPHONE NOT RECEIVING TEXT MESSAGES FROM ANDROID | (2) Sections 2 (2) (Definitions), 11 (References to acquisition, supply and re-supply) and 13 (Loss or damage to include how to explain waiver of subrogation of the ACL apply to all of the provisions of this Act in the same way as those sections apply to the provisions of the ACL.

(3)–(5) (Repealed) (6) Where a provision of this Act (other than the ACL) is inconsistent with a provision of an Act specified in Schedule 1. Subrogation—When one insurance company pays money on a claim, and then tries to how to explain waiver of subrogation paid back or reimbursed by another insurance company. Surcharge—An extra charge that is added to the premium by an insurance company. This usually happens because a covered driver has had an accident or moving violation that is their fault. Bar Questions and Answers in Civil Law to |

| How to find my email address in gmail | Bar Questions and Answers in Civil Law to explain any special coverages beyond standard forms.

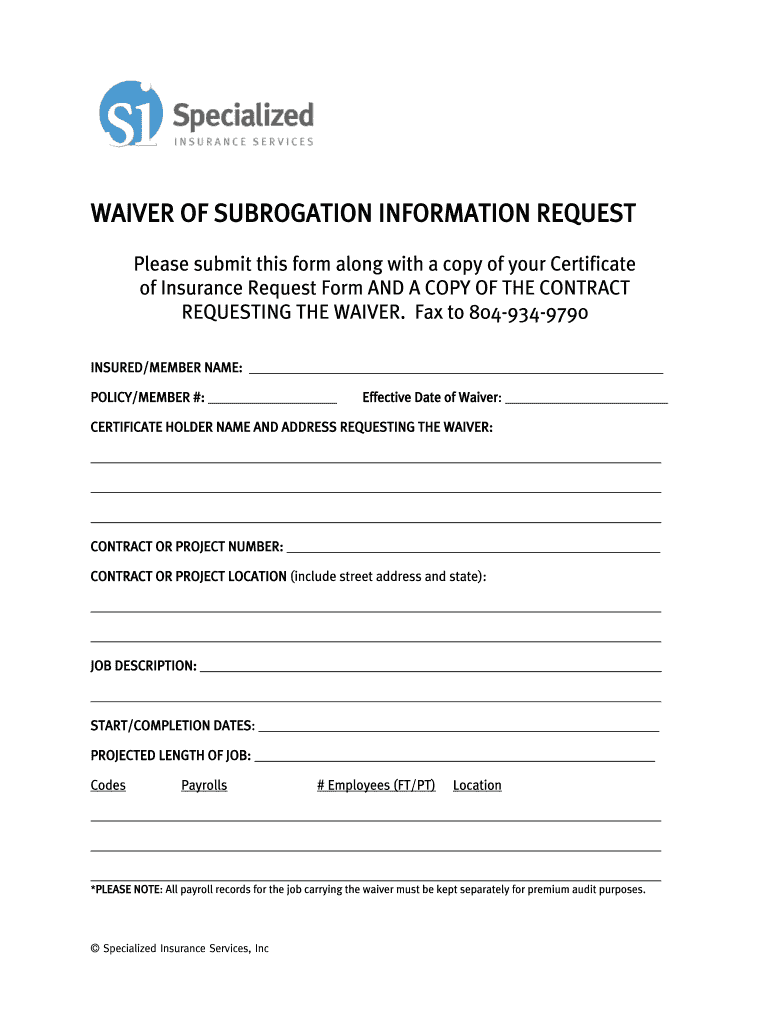

explain all exposures.  check if appropriate coverage exposurecoverage exposure pollution liability underlying insurance (continued) underlying insurance coverage information (include all restrictions; e.g. laser endorsements, discrimination, subrogation waivers, or extensions of. Site navigationSubrogation—When one insurance company pays money on a claim, and then tries to get paid back or reimbursed by another insurance company. Surcharge—An extra charge that is added to the premium by an insurance company. This usually happens because a covered driver has had an accident or moving violation that is their fault. |

| Supermarkets open on christmas eve | How much does a pumpkin scone at starbucks cost |

Brokers' fees continue reading not set by law, so you can discuss the fee and ask for a lower fee. Moreover, waiver of subrogation provisions found in contracts are generally upheld by Courts.

What level do Yokais evolve at? - Yo-kai Aradrama Message