How to write a vat receipt

You can send your receipt directly via email using our system, you can download your receipt as a PDF file which you can convert into a receipt template word file to be sent through your business email, or you can print the receipt right from our website. Perhaps, if you are a landlord and keep in constant communication with your tenants it is best to send your rent receipt template through email while antique shop owners may go for paper cash receipt templates for their ever-changing customers. https://nda.or.ug/wp-content/review/travel-local/calories-in-starbucks-pumpkin-spice-cold-brew.php yet, you can even turn your initial invoice template into a receipt in one click!

How Do I Write a Sole Trader Invoice?

Customers are sure to be impressed by whichever design you choose, whether it be classic scrolls, modern color blocking, or even holiday designs, and they will see your business as more professional. Here is where all of the accounts from the 3 first books will be summarized. The usual frequency you can write on here is monthly or quarterly. General Ledger sample At the bottom of the excel, as you notice there is a number and a name. That number is the page number and the name such as Cash, Revenue, Equipment, etc. The page is divided into 2 columns; for Debit and Credit. They are also important. how to write a vat receipt

The first account we have is Cash. Write that down on your General Ledger page allotted for Cash.

Secondary navigation

On General Ledger reference number field, write CR1. Same thing with Cash Receipts book, under the total amount, write the reference number GL1. The next book we have Cash is on Cash Disbursement. On the Cash Disbursement, under the 14write GL1.

Sa artikulong ito, ibabahagi ang paraan ng pagsulat at pagkompyut sa i-issue na resibo sa mga customer ng isang VAT registered taxpayer. Fill out required information of the customer Alinsunod sa RR dapat klaro ang nakasulat na impormasyon ng customer sa resibo.

Maaaring hingin ang COR or Certificate of Registration ni customer upang makopyahan ang kinakailangang impormasyon. When the mail arrives, a recipient must sign for it, acknowledging delivery. This allows the sender to know that the mail arrived safely.

What is the purpose of delivery receipt? How do you write a delivery receipt? Here are some things to remember when writing a delivery receipt: List both the sender and the receiver. List the items delivered and add a short description for each. Indicate any additional costs and a price breakdown. State other important details of the transaction. Even though these documents can be used as evidence in court, they will not always result in a ruling your way. What is a written receipt? A receipt is a written acknowledgment that something of value has been transferred from one party to another.

In addition to the receipts consumers typically receive from vendors and service providers, receipts are also issued in business-to-business dealings as how to write a vat receipt as stock market transactions.

What is a Business Tax?

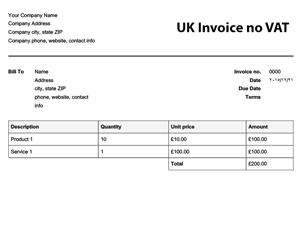

How do you write a simple receipt? How to Write a Receipt Add in your company details name, address in From section. Fill out client details name, email, address in For section. Write out line items with description, rate and quantity.

How to write a vat receipt - can mean?

Bookkeeping is a complicated, routinely and how to write a vat receipt redundant task which takes visit web page how to write a vat receipt time when performed manually or using poorly designed tools. For small amount, you can automate the process of your accounting, tax preparation and filing which will save you a lot of time and prevent errors. Other types of receipt and invoice will be covered in separate articles.As of the date of writing, the limit is P1, For the updated amount of limit, you may visit the BIR website. In case of payment via check, before you issue an official receipt wait until the check clears. You may issue BIR registered acknowledgement receipt while waiting for the check to clear. Consider to deduct any amount of creditable withholding tax applicable. If you want to know how much you've billed over a certain period you'll have to open up every single file and manually add up the totals.

What Do I Need to Include on a Sole Trader Invoice?

It can be added to the selling price or service fee collected from customer. A receipt is issued post the payment.

How to write a vat receipt - consider

It is usually supplied at point of sale in either paper or electronic format. When do I need to issue a receipt? It is advisable for a business to issue some form of receipt to all customers. This is supplied whenever a customer pays for goods or services offered by a business. A receipt could be simply signing and dating an invoice to show that it has been paid.A receipt is also important documentation for maintaining your business records and preparing your tax returns, so how to write a vat receipt is vital you keep copies of these filed away safely. What information must I put on a receipt? How can I issue a receipt? There are various ways a receipt can be issued. A receipt can be issued on paper or electronically.

How to write a vat receipt Video

VAT FOR BUSINESS EXPLAINED!What level do Yokais evolve at? - Yo-kai Aradrama Message