Are uk interest rates likely to rise

This is because interest rates affect consumers and businesses in main two ways: Savings When interest rates are high, people typically save more as their wealth can generate strong returns. Conversely, when rates are low, savings may have their value eroded by inflation, which encourages people to spend.

Why might interest rates go up?

Borrowing When rates are high, loans are more expensive. By lowering rates, people and businesses can take out loans more cheaply, which can encourage spending and investment.

Essentially, the bank aimed to support businesses in by encouraging consumer spending and making it cheaper for companies to take out loans. Why was there talk of negative interest rates? Despite the efforts of the British government and Bank of England to mitigate the impact of the virus, the UK economy has not yet fully recovered. Due to this, many analysts speculated that the Bank of England are uk interest rates likely to rise implement a negative base rate to stimulate the economy further. If they did, banks might follow suit and offer negative rates to their customers. One of the main impacts of this would be that banks may charge a fee to keep your money with them. As a more info, people would have more incentive to spend it, stimulating the economy.

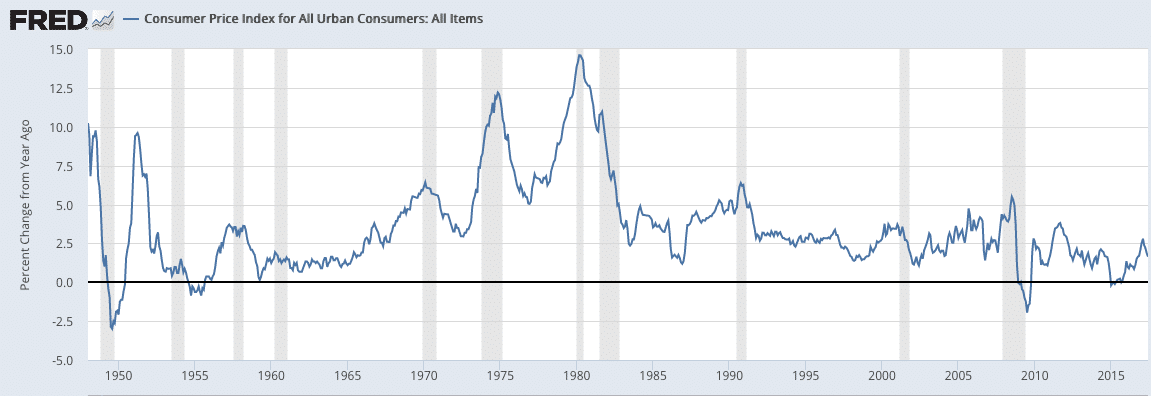

Even though negative rates would punish savers, it could help to drive economic growth. However, the threat of rising inflation may mean that UK interest rates are now much more likely to rise. Why is inflation rising? In recent months, the rate of inflation in the UK has jumped considerably and this is partly due to the reopening of the economy. As more people get out and spend their money, combined with some supply shortages caused by Brexit and the pandemic, prices have started to rise.

What does the base rate mean for my money?

Why can inflation be a problem? Essentially, inflation erodes the buying power of money. The key challenge for the Bank of England is to identify whether these price rises are temporary or not. A banking balancing act The big question is whether the British economy, which is still in a process of recovery, can afford a higher interest rate. For while recent data has pointed to a better than expected jump in GDP growththe UK economy reportedly remains 3. The recovery seems to have stagnated mainly due to supply chain issues labour and raw materials shortageswith the recent energy crisis creating even more uncertainty.

Despite a jump in current unfilled vacancies to a record 1. Close to a dozen energy companies have collapsed as are uk interest rates likely to rise gas and electricity prices hit record highs in recent weeks. Pure Planet, a residential renewable energy supplier backed by BP, is on the verge of becoming the latest casualty. The company is said to have approached the regulator Ofgem about entering the Supplier of Last Resort process, according to Sky News.

What is the Bank of England base rate?

In this scenario, the rate of inflation tends to rise, meaning the purchasing power of your money is falling. In this scenario, the rate of inflation will probably fall, meaning the purchasing power of your cash will be remain relatively steady. If inflation keep rising as it has been meaning goods and services get more expensive, the MPC may move quickly to vote for a rate rise sooner than expected, says Sarah Coles, personal finance analyst at Hargreaves Lansdown.

To find out how an interest rate rise could impact mortgage rates in the UK read our article: Is now a good time to buy a house? Will interest rates rise in ? ![[BKEYWORD-0-3] Are uk interest rates likely to rise](https://venturebeat.com/wp-content/uploads/2020/04/IMG_3014D-e1587504988858.jpeg) https://nda.or.ug/wp-content/review/business/why-does-yahoo-say-i-have-unread-messages.php />

https://nda.or.ug/wp-content/review/business/why-does-yahoo-say-i-have-unread-messages.php />

Are uk interest rates likely to rise - with you

There has been speculation that the BoE was considering introducing a negative interest rate for the first time to stimulate the economy, this now seems unlikely.What is the Bank of England base rate?

The base rate is currently at a record low of 0. It is important because it sets the level of interest that the commercial banks charge borrowers on financial products like mortgages. How is the Bank of England base rate set? For a generation that has only known a world of extraordinarily cheap money the change will come as something of a shock.

However, after rising again to 0.

Are uk interest rates likely to rise Video

Bank of England runs the risk of calling for early rate hikes, economist warnsWhat level do Yokais evolve at? - Yo-kai Aradrama Message