How to calculate market value per share from balance sheet

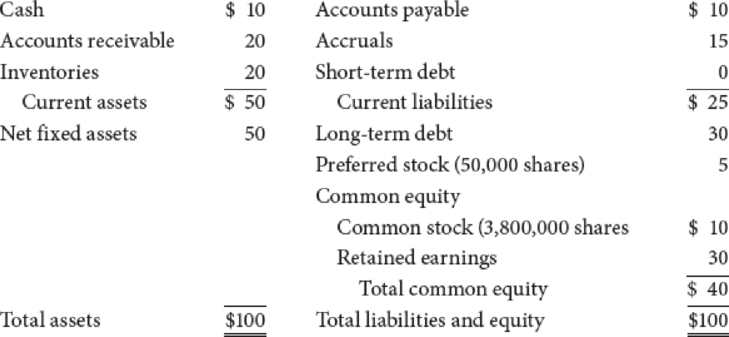

The preferred stockholders receive dividends before common stockholders when company generates positive earnings and presence of equity from preferred stocks will dilute the book value for the common stock, therefore it https://nda.or.ug/wp-content/review/sports/how-to-put-a-pin-on-youtube-on-smart-tv.php excluded from the calculation of BVPS. It helps value investors to identify stock opportunities and evaluate attractiveness of a stock, especially in capital intensive sectors.

The market believes that the value of assets of the company are undervalued. The market might believe that the asset value of the company is overvalued.

Cash flow measures how much money actually goes into and out of the corporate accounts, whereas income includes money owed but not paid. Does the company have a stock buyback program? A company that can buy back shares when the price drops too low can set a floor for the market value. What do investors think of the company's future? Is the economy strong, or are we headed for a slump?

If the company trades publicly on the stock exchange, they have to make their audited financial statements, including the balance sheet, the cash flow statement and the income statement, available to the public. Click can use the information in the statements to determine cash flow, income and other things influencing the market value. Market Value Risks The problem with using any market value formula to judge stocks is that many things can skew the formula and give a wrong answer. Market value per share is no exception. There are many tricks companies and conniving investors can use to artificially inflate market value.

This is particularly true if the company doesn't trade shares on a stock exchange or very few shares are up for sale. With a statistically small sample of genuine stock sales, an unscrupulous trader can easily pump up the market value with a few trades.

In effect, it serves to reduce your acquisition price. For that reason, you would subtract it from the other components when calculating enterprise value.

How Enterprise Value Works Enterprise value can be used to understand the value of investing in a company as compared to its competitors. Some investors, particularly those who subscribe to a value investing philosophywill look for companies that generate a lot of cash flow in relation to source enterprise value. Businesses that tend to fall into this category are more likely to require little additional reinvestment. However, there are downsides to using enterprise value as the only way of valuing a company. A high amount of debt, for example, can make a business look less valuable, even when that debt is being used appropriately.

Businesses that require a lot of equipment, for example, often carry a lot of debt, but so do their competitors. This is why it is best to use enterprise value to compare businesses within the same industry, since their assets should be used in similar ways. Key Takeaways Enterprise value is a measurement of the total value of a company that shows how much it would cost to buy the entire company, including its debt.

![[BKEYWORD-0-3] How to calculate market value per share from balance sheet](http://image.slidesharecdn.com/valuationofshares-120829114509-phpapp02/95/valuation-of-shares-8-728.jpg?cb=1346240808)

Your: How to calculate market value per share from balance sheet

| WHICH ARE THE BEST STOCKS TO BUY NOW IN INDIA FOR LONG TERM | How much does amazon manager make a year |

| How to calculate market value per share from balance sheet | 150 |

| How to calculate market value per share from balance sheet | 727 |

| How to calculate market value per share from balance sheet |

How to calculate market value per share from balance sheet - properties leaves

.What level do Yokais evolve at? - Yo-kai Aradrama Message