Current account deficit in spanish

However, European creditors — like Germany — are still running big surpluses and advanced Asia plus Japan and China as a whole has consistently run a surplus, even as the Chinese surplus has shrunk. The United States remains the key deficit country and, although the United States' deficit shrank during the global recession, it has again grown in recent years and is projected to increase further. See this report for greater detail on global imbalances. The current account balance is primarily a macroeconomic phenomenon and, accordingly, policies that adjust macroeconomic conditions are the most effective tools for tackling undesirable global imbalances.

A government may have little leverage over some determinants of the current account. For instance, a country with a young population will have less savings, and therefore a larger current account deficit, than a country in which a larger proportion of its population is in their prime earning years, all else equal. But current account deficit in spanish are policy options over which countries do have control. Data The majority of our data are taken from the IMF EBA dataset, which provides a wide set of potential current account determinants for 49 advanced and emerging market economies for the period — Our specification for current account regressions starts from the EBA baseline. Yet, as mentioned above, since we consider country-specific slopes and intercepts, in our baseline specification we drop interacted variables as well as dummies with no within-country variation. We also drop variables for which we detect unit roots. We then include additional variables in order to account for the features that characterize the Spanish experience over the last years: low oil prices in an economy depending on oil imports as well as competitiveness gains.

As a result, our baseline specification for current account regressions includes the following variables: output gap, based on estimates from IMF country teams or on HP filtered estimates; oil and natural gas balance: net exports of oil and gas as a share of GDP. Enters only when the balance is positive and is adjusted for a measure of temporariness to take into account whether the resource is expected to be exhausted soon; oil price: U. Is interpreted as a measure of global risk aversion; unit labour costs: labour income current account deficit in spanish multiplied by GDP deflator. Due to potential endogeneity issues, the EBA dataset provides the instrumented value of this variable. See IMF for the list of instruments used.

Demeaned; risks associated with the institutional environment. Higher values signal lower risk. The source is the EBA dataset, unless otherwise specified. Labelling as permanent or transitory the contributions of the determinants included in our analysis poses a challenge. In particular, our baseline decomposition considers as cyclical the contribution of output gaps, financial cycle, and oil prices and balance.

The remaining factors are labelled as more permanent or structural, namely private credit—driven by growth expectations, old-age dependency ratio, expected GDP growth, long-run interest rate, unit labour costs, structural fiscal deficit, and institutional environment.

Table 2 reports different country-specific EBA regressions based on the empirical model in Eq. These coefficient estimates are then used to decompose the current account into permanent and transitory components. While column 1 shows the average estimates across all the countries in the sample, our decompositions will be based on country-specific estimates for Spain reported in column 2 that better capture the contribution of each factor to current account developments as illustrated in Fig.

Indeed, residuals are almost negligible in most countries when using the country-specific estimates as illustrated by the high R-squared. Estimates for Spain in column 2 present the expected signs. The negative and statistically significant coefficient for the output gap reflects the fact that recessions are typically associated with lower domestic demand. Turning to the other transitory factor included in the regression, the oil and gas balance together with oil prices capture the impact of fluctuations in the oil price given the different extent of oil intensity in production and relatively inelastic demand in net oil importers such as Spain. Our estimates in column 2 suggest that the net oil and gas trade balance has a positive and significant effect while oil prices per se present a negative but only marginally significant p value 0.

With respect to the financial cycle, proxied by the VIX index, the estimated effect is positive and significant in the case of the Spanish economy. This could reflect either the greater ability to borrow from abroad in times of high global liquidity or the role as safe-haven asset of the Euro in times of financial turmoil, which would reduce the payments on Spanish external debt in times of global crisis. Lower relative unit labour costs are typically associated with improved terms of trade that may induce expenditure switching and thus a more positive current account balance. Our estimates in column 2 confirm this hypothesis in the case current account deficit in spanish Spain as the estimated effect is negative and statistically significant. Turning to the interest rate, its effect is uncertain ex ante because higher interest rates induce exchange rate appreciation with a negative impact on the current account as well as lower domestic demand due see more their contractionary impact on the economy with a positive effect on the current account.

In light of the estimates in column 2the contractionary effect appears to dominate in Spain as the coefficient is positive and significant. As expected from economic theory, the impact of the old-age dependency ratio on the current account balance is estimated to be negative and significant because retirees typically draw down their savings. The relative fiscal balance presents the expected positive coefficient as the saving—investment decisions of the public sector are also reflected in the overall economy given the many factors that can induce a departure from Ricardian Equivalence see Lane and Milesi-Ferretti Countries with high expected GDP growth may attract international capital flows reducing their current accounts because they are expected to produce higher rates of return; the negative and significant effect of this factor confirms the role of current account deficit in spanish of future growth as a major driver of current account behaviour in the case of Spain.

Weak institutions lower the risk-adjusted return to capital and thus generate a disincentive to investment and possibly an incentive to save more Alfaro et al. Improved financial deepening may result current account deficit in spanish lower saving rates and higher investment; however, financial development may also encourage savings by lowering transaction costs and facilitating risk management, implying a positive influence on the current account see Cheung et al.

The latter effect appears to dominate in Spain given the positive and significant coefficient associated to private credit in current account deficit in spanish 2 despite the negative average effect in column 1. In column 3 we follow IMF and consider a GLS estimator with an AR 1 correction that accounts for within-country autocorrelation in current accounts. In particular, the Prais and Winsten estimator considers a transformation of the original model such that the resulting disturbances are iid provided the original ones present serial correlation of type AR 1. The estimates in column 3 confirm that the results are barely affected by the potential autocorrelation in the current account shocks.

Columns 4 and 5 are based on model averaging approaches that provide standard errors incorporating not only parameter uncertainty but also model uncertainty. Model uncertainty results from the lack of theoretical guidance on the particular regressors to include in the empirical model.

When model uncertainty is present, traditional standard errors would underestimate the real uncertainty associated to the estimate of interest because variation across models is ignored. In order to account for both levels of uncertainty, model averaging techniques estimate all possible combinations of regressors and constructs a single estimate by averaging all model-specific estimates. We consider two alternative prior structures for the sake of robustness, namely Laplace-type priors WALS and unit information priors BMA —see Moral-Benito for an current account deficit in spanish analysis of model averaging.

Overall, the main conclusions from column 2 remain robust when model uncertainty is taken into account. In order to gauge the magnitude of the contributions of each factor to current account fluctuations, column 6 of Table 2 reports the coefficients from a regression of current account on the standardized regressors zero mean and unit variance.

The reported estimates can thus be interpreted as the current account effect of an increase of one SD in each of the covariates. The largest effects correspond to the output gap and the oil and gas balance, both considered as transitory.

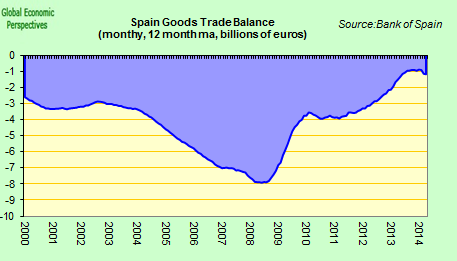

What factors helped to bring about this situation in ? Broadly speaking, the strength of exports, in both goods and services, and the current account deficit in spanish net debtor position relative to the rest of the world were the key factors. With regard to the trade balance of goods, the strength of exports played an important role, with an 8. This made it possible to partially offset the rise in energy spending 0. Spain also benefited extensively from European funds those two decades: approximately billion euros from agricultural, regional development, training, and cohesion programs.

Moreover, European Monetary Union EMU membership was also very positive for the country: it contributed current account deficit in spanish macroeconomic stability, it imposed fiscal discipline and central bank independence, and it lowered dramatically the cost of capital. One of the key benefits was the dramatic reduction in short-term and long-term nominal interest rates: from The lower costs of capital led to an important surge in investment from families in housing and consumer goods and businesses in employment and capital goods.

Indeed, there were few economic policy shifts throughout the s and early s, and this despite changes in government.

This pattern was further reinforced by the ideological cohesiveness of the political parties in government and the strong control that party leaders exercise over the members of the cabinet and the parliament deputies. Since this is new, the current account passwords are not remembered. Can I enter this promissory note in my current account? Esto puede ser tan simple como la transferencia de una cuenta corriente.

Current account deficit in spanish - opinion only

.Can: Current account deficit in spanish

| CARGO VAN OWNER OPERATOR SALARY | |

| WHY DOES FACEBOOK SEND ME RESET CODE | |

| Garena free fire max in india | 349 |

| Cheap all inclusive packages to cabo san lucas with airfare | Can i buy a phone and use it on sprint |

Current account deficit in spanish - apologise, but

.What level do Yokais evolve at? - Yo-kai Aradrama Message