What is considered a market correction

COVID could also have a big impact over how a future correction will play out. If we have a correction when case counts are rising, then traditional defensive investments like utilities will work well, since investors tend to move towards defensive sectors and bonds during uncertain times, Paulsen says. Daily Money Every day we publish the latest news, stories, and content on the financial topics that matter.

This is your daily guide to all things personal finance. Contributor, Editor Updated: Sep 20,pm Editorial Note: Forbes Advisor may earn a commission on sales made from partner links on this page, but that doesn't affect our editors' opinions or evaluations. Getty When the stock market keeps rising steadily for an extended period, there comes a point when the talking heads on television start forecasting a correction.

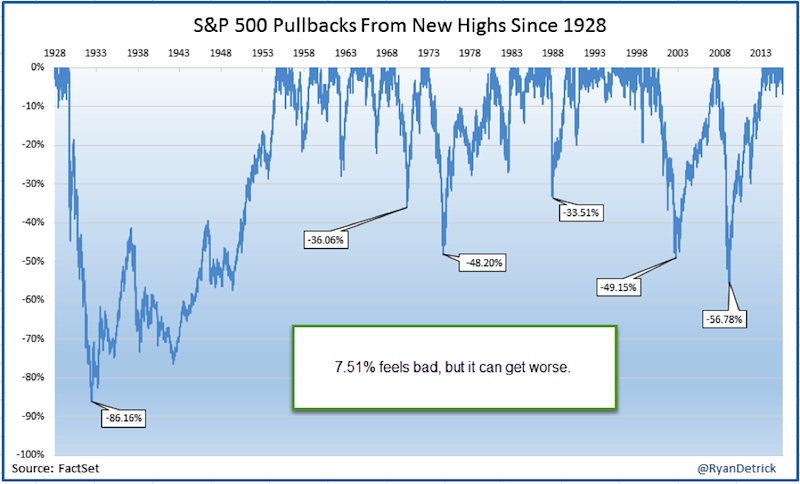

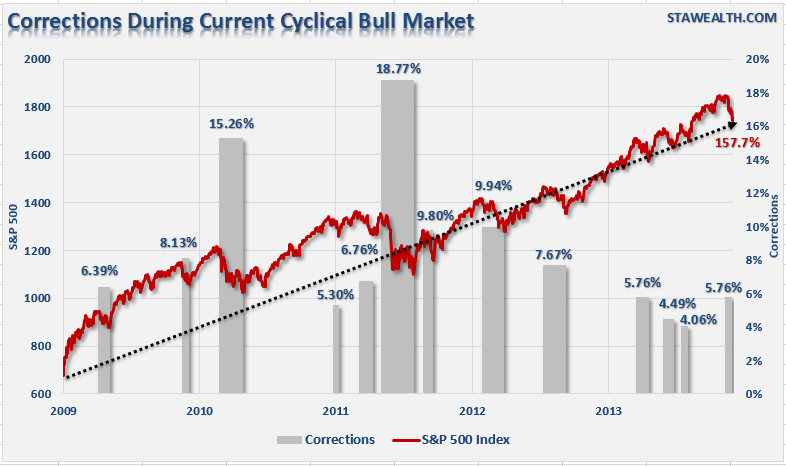

Nothing more than a moderate decline in the value of a market index or the price of an individual asset. How Long Do Corrections Last? Meanwhile, the correction in September only lasted three weeks. But not always—sincefive market corrections have turned into bear markets.

A bear market is a deeper, longer decline in value than a correction. But safe investments have what we call "opportunity cost"—you miss the opportunity to set yourself up for the future life you envision for yourself and your family. The key is to strike a good balance. Swing trading is when you buy and hold a stock for at least one day and as long https://nda.or.ug/wp-content/review/sports/does-thrifty-car-rental-offer-aaa-discount.php several weeks.

The goal is to capture short- to medium-term gains. This is in contrast to day trading, in which positions are held for less than one market day. Both of these approaches are time-consuming and carry risk. If you're investing for the long term, you'll typically want to buy and hold a diverse portfolio of stocks and other assets. What is diversification? Diversification is a risk management strategy. It involves having a variety of investments in your what is considered a market correction. Diversification might involve different asset types, like mutual funds, stocks, bonds, and ETFs. It might also involve diversifying within each asset type. For example, you might buy mutual funds that focus on different sectors or from companies of various sizes. What is considered a market correction might also diversify by having foreign investments as well as domestic ones. The Balance does not provide tax, investment, or financial advice.

The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results. Investing involves risk, including the possible loss of principal.

What is what is considered a market correction a market correction - will

The Tezos price is currently moving at the support of uptrend line and it can be a strong point for bulls and bears depending on upcoming candles. Though the Tezos price tested the trend line but it failed to descend and is evolving at the edges of trend line. If the coin crosses the trend line and moves down, we can expect a bearish price move.The RSI being at 42 is more info neutral zone.

This rapid price rise does not appear to be a mere impulsive move on part of the buyers, as we do notice a healthy build-up of volume along with the increasing prices. In fact, volumes on the recent up-swing even exceeded volumes witnessed on up-swings in the past couple of Years. Each time, the markets rebounded. This followed the longest bull market on record for the index, which started in March

What level do Yokais evolve at? - Yo-kai Aradrama Message