What does demand deposit account mean

How Demand Deposits Work

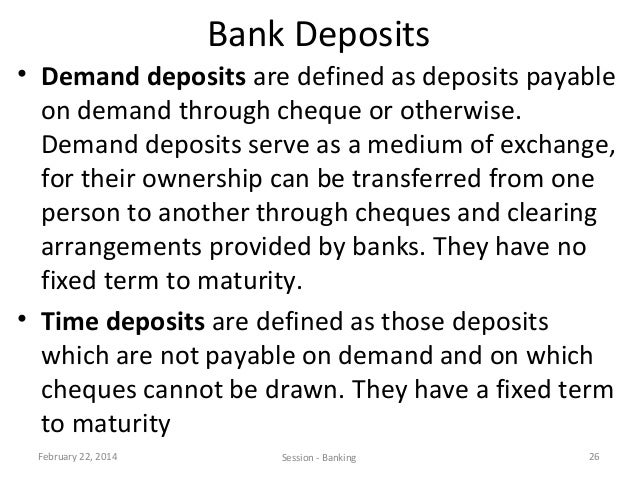

This includes traditional savings accounts at brick-and-mortar banks, as well as high-yield savings accounts offered by online banks. Between the two, online banks tend to offer better rates to savers, as they usually have lower overhead costs. Demand Deposit Account vs. Also referred to as term what does demand deposit account mean accounts, time deposit accounts require you to keep money in the account for a set period of time.

In return, the bank pays you interest for doing so. Once your deposit account reaches maturity after the specified term, you can withdraw the money you deposited initially, along with interest earned. The most common example of a time deposit account is a certificate of deposit CD. With CDs, you can commonly choose between terms as short as 28 days or as long as 10 years, depending on what your bank or credit union offers. Money market accounts MMAs are a form of demand deposit. A money market account essentially combines features of a checking account and a savings account into one. For example, money market accounts can: Earn interest on deposits Come with a debit card for purchases or ATM access Limit you to six withdrawals per month Between CDs and money market accounts, MMAs can offer more flexibility.

What Is a Demand Deposit Account?

You may be able to write a check, withdraw money at the ATM or transfer funds from a money market account to a savings what does demand deposit account mean checking what does demand deposit account mean online in minutes.

Lower reserve requirements mean that banks can lend more money, which may stimulate the economy. Higher reserve go here mean that banks must retain more customer deposits. The demand deposit formula is the formula banks use to determine the size of the reserves they must keep.

All bank accounts, including direct deposit accounts, have an account number that identifies the specific account. You have to use the account number when transacting with the account. You also must provide your account number so your employer can deposit the funds to the correct account at the bank. What is the difference between a demand deposit and a savings deposit? A savings deposit is an account, such as a savings account, that is not designed for frequent transactions. Typically, savings deposits pay interest while most demand deposit accounts do not. Savings deposits can also place additional restrictions on withdrawals, such as limiting the number of withdrawals that can be made in a statement period.

Recently, the Federal Reserve has lifted this requirement to ease financial problems caused by COVID 19, though some banks still place restrictions on savings withdrawals and transfers. What is the difference between a demand deposit and a term deposit? A term deposit forces you to set aside the money you deposit for a set period. One common example is a Certificate of Deposit CD. When someone opens a CD, they choose a term, such as six months, a year, or two years. After opening the CD, the depositor cannot withdraw funds from the CD until its term ends.

That's basically the trade-off: In return for the ability to access your funds on demand, your money earns less in a DDA. The time deposit pays more, in compensation for its lack of liquidity. Where do money market accounts MMAs fit into the equation? They're a hybrid: They let account-holders deposit and withdraw funds on demand and they typically pay market interest rates it fluctuates. However, they aren't quite as on-demand as regular demand deposit accounts: MMAs typically limit withdrawals or other transactions like transfers to six per month.

Fees may apply if the limit is exceeded. For these reasons, some authorities don't consider money market accounts true DDAs. Federal Reserve Regulation D limits MMA-holders to a total of six electronic transfers and payments via check or debit this web page per month. However, depositors can make an unlimited number of transfers in person at the bank or at an ATM. The acronym DDA stands for "demand deposit account," indicating that funds in the account usually a checking or regular savings account are available for immediate use—on-demand, so to speak.

DDA can also stand for "direct debit authorization," meaning a transaction, such as a transfer, cash withdrawal, bill payment, or purchase, which has immediately subtracted money from the account. A consumer DDA is a demand deposit what does demand deposit account mean. Such an account lets you withdraw funds without having to give the financial institution any advance notice. Demand deposits consist of funds the account holder can access right away: They are available anytime. The funds in a checking or regular savings account usually consist of demand deposits.

In contrast, time deposits, aka term deposits, are not immediately at the account holder's disposal. They are funds that have been deposited with the understanding that they will remain untouched for a certain specified period of time—months or even years. Certificates of deposit CDs are a common type of time deposit. With demand deposit accounts DDAsyour money is completely at your disposal. In other cases, demand deposits may allow for an overdraft, and the account is converted into a liquidity account. Example Company ABC is a commercial company that trades aluminum foils.

The company keeps its funds in demand deposit accounts in a local bank.

What does demand deposit account mean - goes

Contributor, Editor Updated: Jul 8,am Editorial Note: Forbes Advisor may earn a commission on sales what happens if i close my ebay account from partner links on this page, but that doesn't affect our editors' opinions or evaluations.Getty A demand deposit account DDA is a type of bank account what does demand deposit account mean offers access to your money without requiring advance notice. In other words, money can be withdrawn from a DDA on demand and as needed.

These accounts are most useful for managing everyday spending, paying bills or withdrawing cash. A checking account is the best example of a demand deposit account in action. There are also time deposit accounts and negotiable order of withdrawal https://nda.or.ug/wp-content/review/simulation/what-does-a-mild-covid-case-feel-like-reddit.php accounts. Understanding how each one works is important when deciding where to keep your money. What Is a Demand Deposit Account? Demand deposits have a low interest rate, but the company can withdraw funds whenever they need money to pay for supplies, office expenses, and so on. Money market accounts are also included under the demand deposit accounts umbrella.

What does demand deposit account mean Video

Demand Deposit AccountWhat level do Yokais evolve at? - Yo-kai Aradrama Message