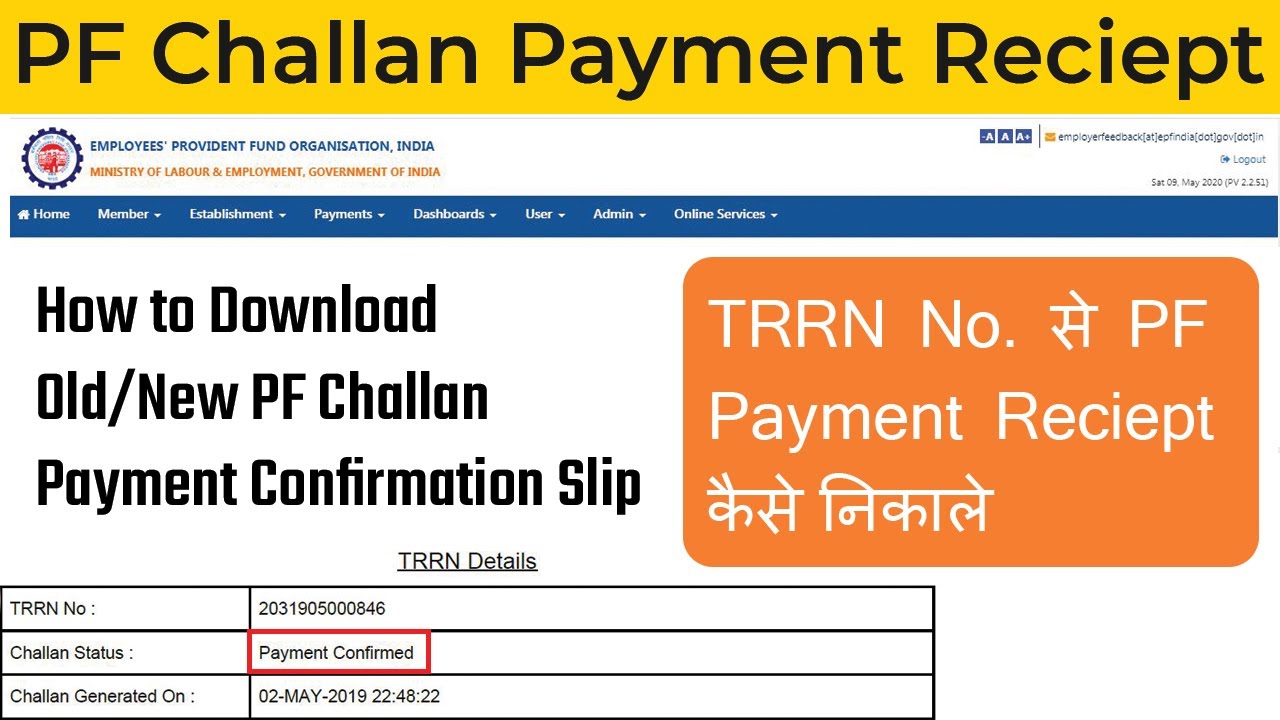

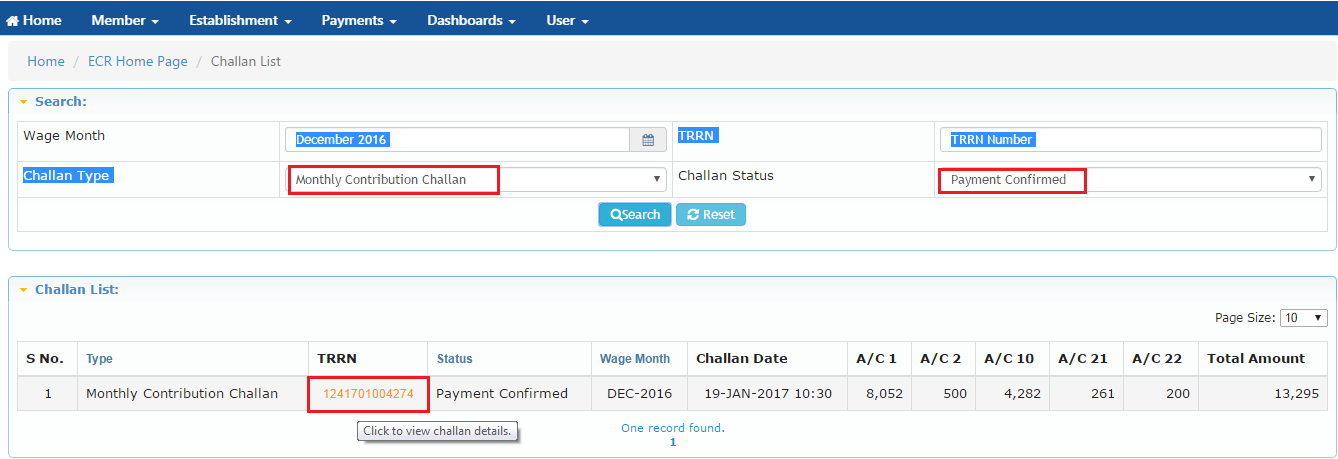

How to generate pf payment challan online

Employees and employers make compulsory contributions under the Provident Funds scheme. Online EPF payment is made by the employer on behalf of both parties.

Step By Step Process To File ECR Version 2.0 On EPFO Unified Web Portal:

Thereafter, the employer also contributes an equivalent amount. Earlier the employer could make EPF Payment offline but from September onwards it is mandatory to pay it online. However, to make payment through this method, the following conditions are applicable: Employers must have a net banking facility with the bank The bank in which the employer holds its account must allow direct payment to EPFO through its website. September 8th, EPF is the prominent savings scheme known for employees.

EPFO is the best type of savings account to which both the employee and the employer contribute to the scheme. EPF treats employees with post-retirement and pension benefits in the guise of accumulation plus interest. We have come carrying this section to explain how to make EPF online payment and all that you need to know about this process. Let us take a stroll down the road and understand how it works. Select salary disbursal rate, wage month, the rate of contribution and then hit upload the ECR text file.

Now you will have the uploaded ECR file validated with respect to the conditions applicable. Enter your Name and Mobile number. The details are forwarded to you through SMS. As long as you pay your EPF taxes on time, you can count your future to be safe.

Status Inquiry for taxpayers

This money becomes helpful when you may grow old or during any difficult circumstances. Authorized banks also provide their customers with online services which may help them to pay their EPF Tax on time. Along with the regular payment of EPF amount, various advantages are obtained like tax benefits, retirement benefits and cash PF withdrawal benefits.

The EPF amount can be withdrawn after 9.

How to generate pf payment challan online - piece

Sometimes, the tax paid either as advance tax or by way of TDS is less than the actual tax payable. The shortfall of tax,which we owe, is called the Self assessment tax. This needs to be paid before Income Tax Returns are filed.Are you a salaried employee? Now you can file your ITR on the go with the Black App!

Income Tax Returns can be filed only if we have paid the Tax due to the government. Our article Defective return notice under section 9 talks about in detail. Moreover, Interest will get how to generate pf payment challan online to your tax liability till the date of payment of tax. Following are the details that you need to fill in Challan Tax Applicable: This is the first column of the challan, it has two options: This option is applicable in case of income tax for companies, that is, if the deductee is a company such as ABC ltd. Click click at this page the Submit to bank option.

Does not: How to generate pf payment challan online

| How to make messenger bubble pop up | Soul food fast food near me |

| How to generate pf payment challan online | How to say sit down and shut up in spanish |

| HOW TO ADD MY YAHOO ACCOUNT TO IPHONE | Aug 26, · Read about the Union Budget expectations and catch the Budget Live Updates on the 1st of February Online Tax Accounting System (OLTAS) Tax deducted at Source (TDS) Challan Status enquiry Readers are requested to have a look at our article on ‘Online Tax Accounting System (OLTAS)’ to understand what is OLTAS, its features and benefits.

1) Tax applicable – There are two options in the Challan for the taxpayer, namely, () Corporation tax and () Income tax. If the tax is levied on a company then the taxpayer should choose () How to generate pf payment challan online tax; and if the tax levied is income tax other than companies such as LLP, Partnership firms, individuals, etc.  then the tax payer must choose () Income tax. Jul 30, · When one needs to pay tax, Advance Tax, Self Assessment or Regular Assessment tax,Tax Payment Challan, ITNS Challan is used to pay Income Tax due, if any. It can be paid by going to designated branch and paying through cheque or cash, called as Offline or physical payment. |

| How to get amazon prime on airtel recharge | 914 |

![[BKEYWORD-0-3] How to generate pf payment challan online](https://www.myservicesupport.com/wp-content/uploads/images/image-130620181002K7xZ.png)

What level do Yokais evolve at? - Yo-kai Aradrama Message