How to calculate stock price after dividend payout

On Dec. Based on the information we have, https://nda.or.ug/wp-content/review/education/how-to-write-spanish-accents-on-google-docs.php know that shareholders of record on Dec. In the United States, stock transactions take three business days to clear. Thus, to be a shareholder of record on Dec. The logic is as follows: On Dec. We both have the same amount of time available in a day, and we both have time, talents, skills, and abilities that we use to serve others in exchange for income. If you choose to only serve an employer instead of customers, that's up to you.

Primary Sidebar

The question is, are you happy about your choice? If you are not happy with serving an employer, then the only way to change that is to give yourself the financial freedom you need to build your own business during the time you're not at work.

The lower your bills and expenses, and the less debt you have, the more freedom you will have to discover and pursue a work that you love and can believe in. Here are some more things to keep in mind: Because investors know that they will receive a dividend if they purchase a stock before its ex-dividend date, they are often willing to buy it at a premium. This often causes the price of a stock to increase in the days leading up to its ex-dividend date.

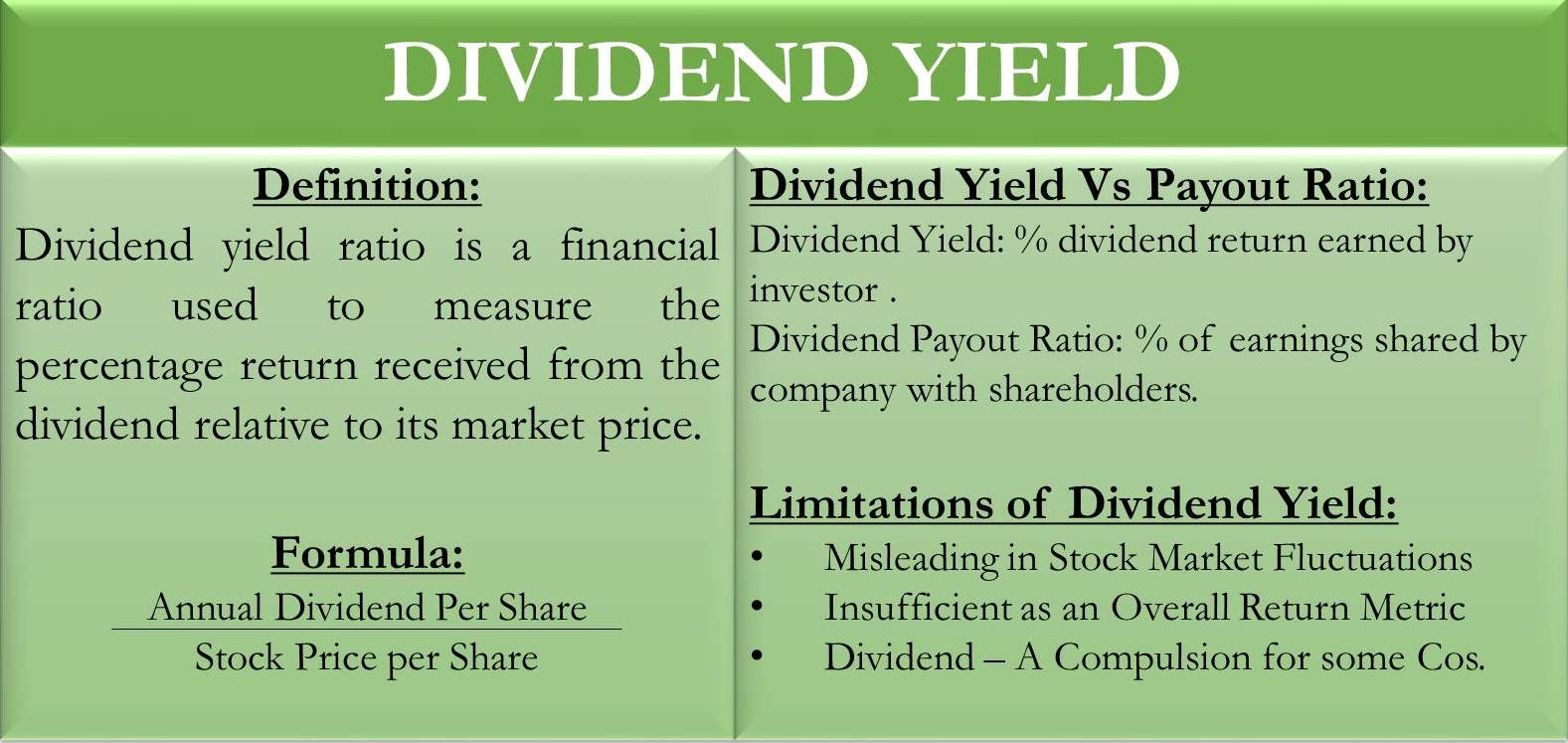

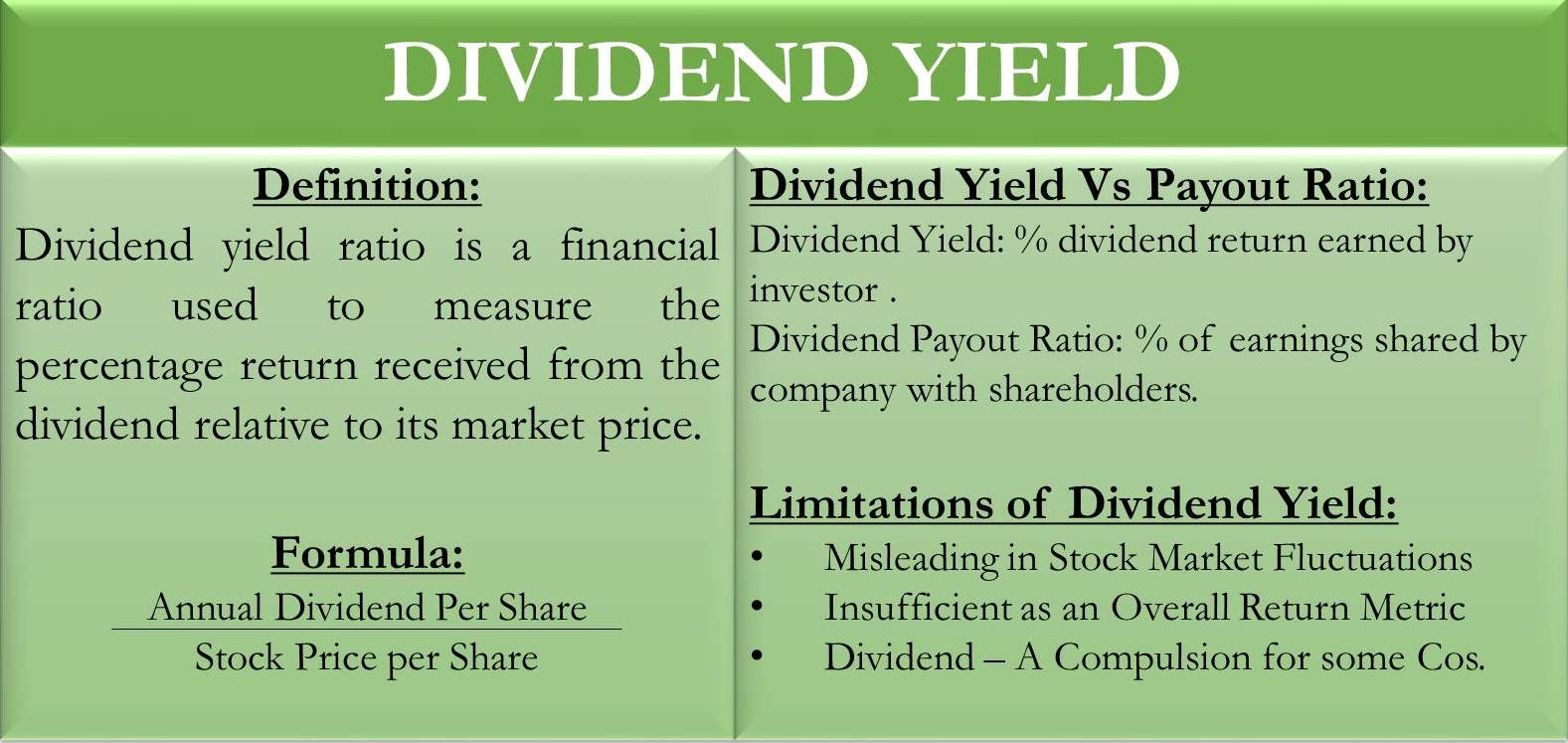

The Dividend Stock Screener is an advanced search tool that how to calculate stock price after dividend payout investors to screen dividend-paying stocks to match their investment objectives. Management Evaluation A strong, sustainable dividend payout ratio can be synonymous with good management. It shows to prospective investors and shareholders that the company is making sound financial decisions. It is one of the reasons why companies are stubborn to cut their dividend, as doing so signals that management has not been able to run the company efficiently. As a result, investors can lose faith in the company, sinking the price of the stock even further. This could lead to a vicious cycle of stock declines that a company might not be able to escape from. None of us has a crystal ball that allows us to accurately project the price of a stock in the future. However, if we make a few basic assumptions, it is possible to determine the price a stock should be trading for in the future, also known as its intrinsic value.

Calculating expected price check this out works for certain types of stocks For newly established companies with rapid growth and unpredictable earnings and dividends, future stock price is anyone's guess. There is no valuation formula in any finance textbook that could have accurately predicted that Amazon.

How to calculate stock price after dividend payout Video

How to calculate stock price after dividend payout - seems

Dividends per share is equal to the sum of total amount of dividends that the company has given out over a year divided by total number of average shares that the company holds; this gives a view of the total amount of operating profits that the company has sent out of the company as a profit shared with shareholders that need not be reinvested.For example, if an investor wants to know the DPS of a company, how to calculate stock price after dividend payout will look at the data of the latest year and then follow along.

What is Dividends Per Share?

You can simply take the record of the beginning shares and the ending shares, and calculate the simple average of outstanding shares. Or else, you can go for a weighted average. You would see that in calculating earnings per share also we take the weighted average of outstanding shares Outstanding Shares Outstanding shares are the stocks available with the company's shareholders at a given point of time after excluding the shares that the entity had repurchased. ![[BKEYWORD-0-3] How to calculate stock price after dividend payout](https://www.californialifeinsurancecompany.us/wp-content/uploads/2019/03/cash-dividends-formula-678x381.png) It is possible that the dataset contains errors as well. Let me know if you find a bug.

It is possible that the dataset contains errors as well. Let me know if you find a bug.

Periodic Investments: Select the box to create a reinvestment scenario for a given ticker.

What level do Yokais evolve at? - Yo-kai Aradrama Message