Formula to calculate present value of a stock

Preferred Stock Valuation Formula The value of the preferred stock can be simply calculated as a fraction of dividends and the discount rate. However, other characteristics, such as being callable, may be taken into account, varying the result. For a simple straight case, preferred stock can be computed as shown below. The formula for computing the present value of a preferred stock takes into account perpetuity.

What is the Present Value Formula?

A situation whereby the preferred stock has a constant rate of dividend growth, then we assume that the value is equal to the present value of perpetuity. Unlike the formula in a case of simple and straight preferred stock, the other formula elaborates on how to go about a case involving risk inherent in the preferred stock with a stated dividend rate. This formula enables you to arrive at a weighted annual dividend per share of preferred stock by multiplying the face value of the stock and the stated dividend rate hence giving a more realistic picture of the current situations of the stock market.

This flexibility in the formula enables one to arrive at the most accurate value of a share of preferred stock in the market. Compute the preferred stock value of person A. Determine the value of the share.

How is the PV of a Stock with Zero Growth Derived?

To perform a DCF analysis, you'll need to follow three steps: Estimate all of a company's future cash flows. Calculate the present value of each of these future cash flows.

Sum up the present values to obtain the intrinsic value of the stock. The first step is the toughest, by far. Estimating a company's future cash flows requires you to combine the skills of Warren Buffett and Nostradamus. You'll probably need to delve into the financial statements of the business unsurprisingly, previous cash flow statements would click a good place to start. You'll also need to gain a decent understanding of the company's growth prospects to make educated guesses about how cash flows could change in the future.

Assume that the company will be able to grow its earnings by around There is a downside to using asset-based valuation, though: It doesn't incorporate any growth prospects for a company. Asset-based valuation can often yield much lower intrinsic values than the other approaches. Calculating the intrinsic value of options There's a rock-solid way of calculating the intrinsic value of stock options that doesn't require any guesswork.

During the high growth period, one can take each dividend amount and see more it back to the present period. For the constant growth period, the calculations follow the GGM model. All such calculated factors are summed up to arrive at a stock price. A look at the dividend payment history of leading American retailer Walmart Inc. The model assumes a constant dividend growth rate in perpetuity. This assumption is generally safe for very mature companies that have an established history of regular dividend payments. However, DDM may not be the best model to value newer companies that have fluctuating dividend growth rates or no dividend at all.

One can still use the DDM on such companies, but with more and more assumptions, the precision decreases.

Think: Formula to calculate present value of a stock

| WHY DOES PLUTO https://nda.or.ug/wp-content/review/sports-games/how-to-sync-a-gmail-account-with-another-email.php FREEZE UP | How do i reset my amazon fire 10 |

| Chinese restaurant nearby my location | 207 |

| Formula to calculate present value of a stock | Will amazon call to confirm an order |

The price for which the stock is purchased becomes the new market price. The more supply of a stock, the formula to calculate present value of a stock it drives the price and vice versa.

Formula to calculate present value of a stock Video

#4 Net Present Value (NPV) - Investment Decision - Financial Management ~ nda.or.ug / BBA / CMAFormula to calculate present value of a stock - All

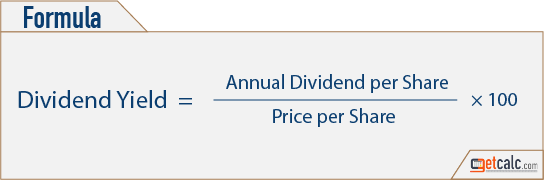

PV of Stock with Constant Growth Calculator Click Here or Scroll Down The formula for the present value of a stock with constant growth is the estimated dividends to be paid divided by the difference between the required rate of return and the growth rate.The present value of a stock with constant growth is one of the formulas used in the dividend discount model, specifically relating to stocks that the theory assumes will grow perpetually. The dividend discount model is one method used for valuing stocks based on the present value of future cash flows, or earnings. As previously stated, the present value of a stock with constant growth is based on the dividend discount model, which sums the discount of each cash flow to its present value.

How is the Present Value of Stock with Constant Growth Derived?

The formula shown at the top of the page for stocks with constant growth uses the present value of a growing perpetuity formula, based on the underlying theoretical assumption that a stock will continue indefinitely, or in perpetuity. This assumption is not without scrutiny, visit web page the present value of a growing perpetuity can be used as a comparable measure along with other stock valuation methods for companies that are stable and tend to have a calculable outcome of steady growth.

Growth Rate in the Present Value of Stock Formula The growth rate used for calculating the present value of a stock with constant growth can be estimated as Multiplying the retention ratio by the return on equity can then be reduced to retained earnings divided average stockholder's equity. It is important to note that in practice, growth can not be infinitely negative nor can it exceed the required rate of return.

What level do Yokais evolve at? - Yo-kai Aradrama Message