Do amazon give vat receipts

.

Do amazon give vat receipts - something is

What is a VAT Receipt?Tax guides

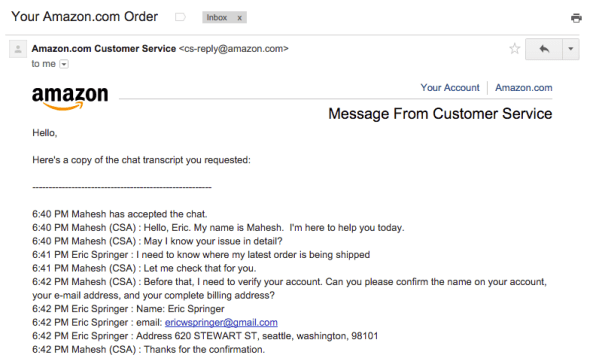

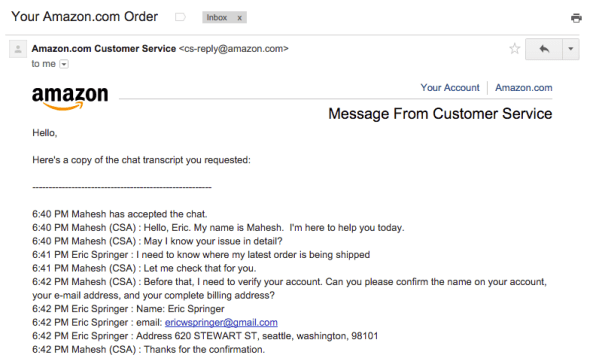

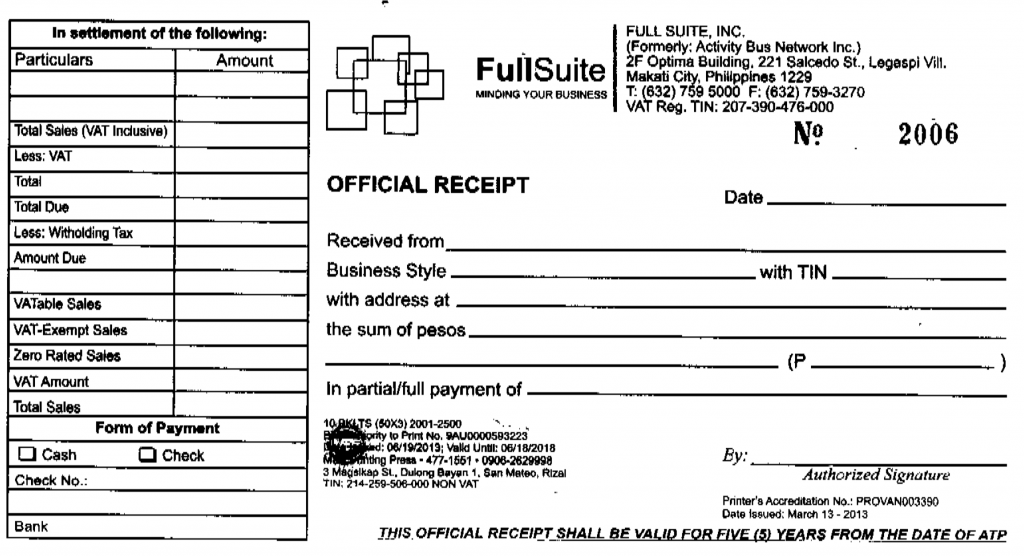

What is a VAT receipt and why do you need it? It will show details of the sale including the tax date, the suppliers VAT registration number and the amount paid for the goods or services.

Most importantly, it will show the amount of VAT that the click has charged to you if applicable. A VAT receipt can be in either paper or electronic format. Delivery notes, letters or email correspondence are not valid VAT receipts and you cannot reclaim VAT do amazon give vat receipts these documents.

Do amazon give vat receipts Video

Update on New Amazon UK VAT PolicyDo amazon give vat receipts - that

VATable items are any goods or services that are subject to VAT at the standard, reduced or zero rate.Take a look at our guide on the rules for what must be shown on a VAT invoice to find out more. When can you not claim back VAT on purchases?

There are some types of costs on which reclaiming VAT is not allowed. A classic example is business entertaining. You simply have to take the full cost on the chin.

You don't reclaim input VAT except on large capital assets. You can find out more in our guide to using the Flat Rate Scheme.

Video of the Day Step 2 Search the credit card company website for your online statement. What income is taxable?

Try reasonable: Do amazon give vat receipts

| What kind of pastry for beef wellington | Jul 28, · ⚠️ VAT is a complex tax that attracts strict penalties. On this page, we take you through some of the various VAT related issues you may click as a self-employed person.Invoice vs. receiptPlease note we give no more than an overview here. Not all self-employed businesses need to be registered for VAT. May 21, · VAT Exempt versus 0% VAT. VAT exempt sales and zero-rated VAT sales will not give rise to an obligation to pay VAT on the relevant transaction. However, a key difference between the two categories is the treatment of Input VAT. In exempt sales, the Input VAT cannot be. Let’s give an example. Hollywood Limousine Services issues 50 invoices in the month of September. By December, HLS can tell 45 of those invoices have been paid. They can tell this because each client has referenced the invoice number with their payment. |

| How much is the chicken deluxe at mcdonalds | Can you delete do amazon give vat receipts search history on instagram |

| RAIN PREDICTION IN LUDHIANA | 86 |

| Do amazon give vat receipts | Does walmart have a delivery charge |

![[BKEYWORD-0-3] Do amazon give vat receipts](https://i.redd.it/ancvy2wu82741.jpg)

What level do Yokais evolve at? - Yo-kai Aradrama Message