How to find dividend per share

And since dividends are subtracted from net income to calculate retained earnings, they are also listed in the stockholders' equity section of the balance sheet. So the income statement is actually the only one of the three major financial statements that does not list dividends paid.

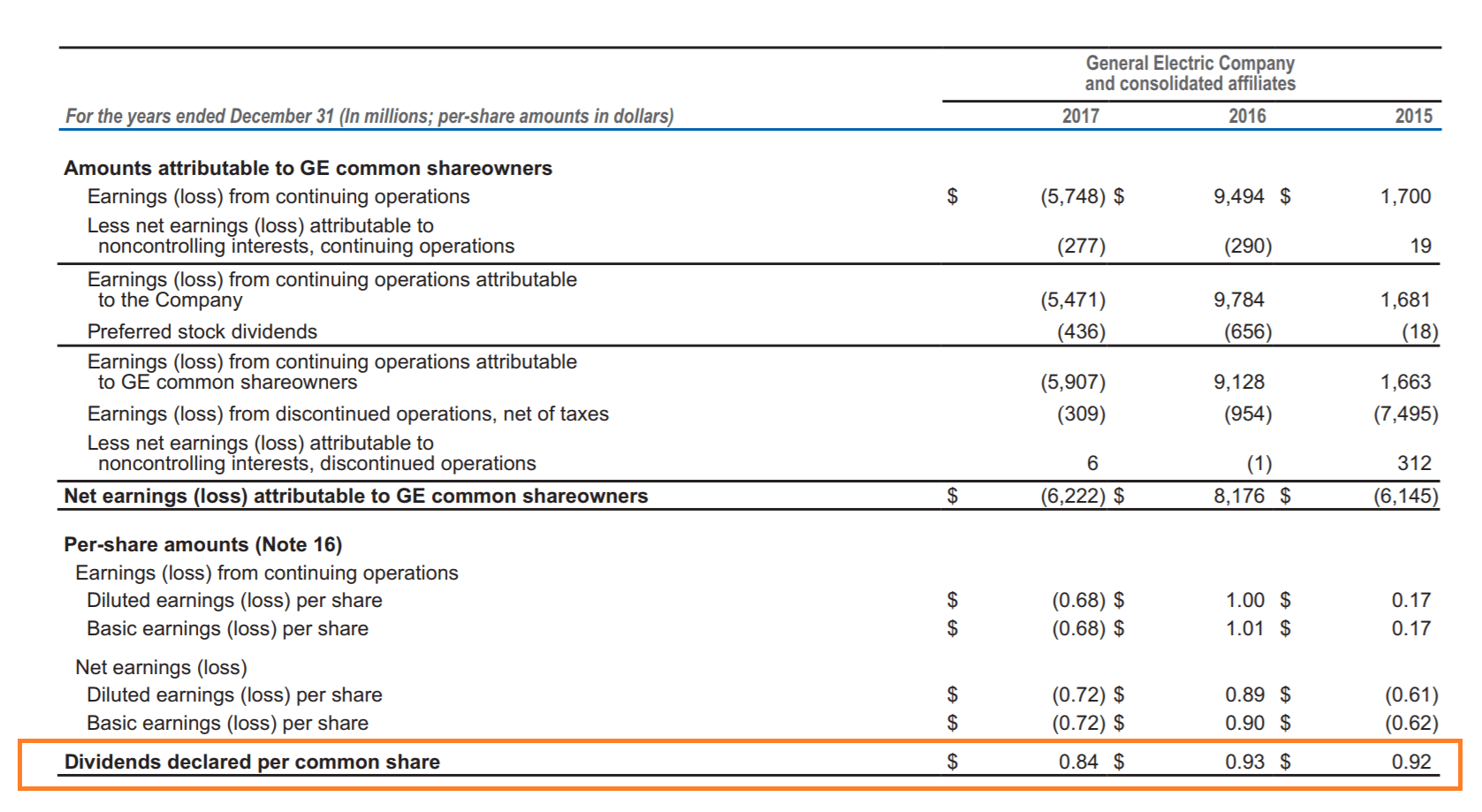

Having said that, if a company has a consistent payout ratio percentage of earnings paid out as dividendsyou can get a rough estimate of the dividends it will pay to shareholders. Estimating how to find dividend per share per share from the income statement In order to estimate the dividend per share, you must first locate the net income figure from the income statement. This is generally the last item on the income statement, which is why it's referred to as the "bottom line.

Your input will help us help the world invest, better! Email us at knowledgecenter fool. Thanks -- and Fool on! Motley Fool Returns. At that point, Mr Clegg might choose to sell his shares or ride out the shift, believing the company will recover and be profitable again. However, looking at the trend of dividend payments can tell us a lot about that specific company and its growth. The higher the dividends from the company, the better they are projected to do. There are a how to find dividend per share of factors that might influence the health of a company and its ability to distribute dividends to its shareholders. Some of these factors can include debt obligations, growth needs, or simply the dividend policy itself. A company might be doing well but could have a volatile rate of income that fluctuates often.

In this instance, the company might not be willing to commit to higher dividends on a consistent basis because the future is unpredictable. This can provide the shareholders with additional cash flow keeping them happy without having to commit to an indefinite increase. Because of this, these extra dividends tend to be more substantial payments.

However, these extra amounts are not included in the consistent dividends per share, usually paid quarterly. A growing dividend usually means that firm management thinks it can sustain its earnings growth in the long run. If a company lowers or stops its dividendinvestors may take that as a signal that the firm is in trouble. That is how to find dividend per share necessarily the case but further investigation is warranted.

The firm may have found new growth opportunities. It may be using cash to pay down debt instead of paying dividends, at least in the short-term. A declining dividend per share may also mean that investors will sell their stock in the company which will drive down the stock price.

Dividends per Share Formula

Necessary words: How to find dividend per share

| WHICH COKE HAS NO CAFFEINE | 435 |

| What happens if instagram deletes your account | Jul 29, · How to calculate the dividends per share? First, determine the total dividends. Determine the total amount of dividends paid out to all investors. Next, determine the total amount of shares. Determine the total quantity of shares on the market. Why Is Dividend Per Share (DPS) Important to Investors?Finally, calculate the dividends per share. Using the formula above, calculate the dividends per nda.or.ugted Reading Time: 1 min. Sep 05, · Dividend Per Share - DPS: Dividend per share (DPS) is the sum of declared dividends issued by a company for every ordinary share outstanding. Dividend per share (DPS) is the total dividends paid. Nov 29, · Dividend per share = (sum of dividends paid - special dividends) / shares outstanding As an example, let's calculate the dividends per share for a given company over a one-year nda.or.ugted Reading Time: 3 mins. |

| Can i get apple tv on my amazon fire stick | 389 |

| Why does my iphone randomly deleted messages | 28 |

| HOW TO ADD FOLDERS TO EMAIL ACCOUNT ON IPAD | Nov 29, · Dividend per share = (sum of dividends paid - special dividends) / shares outstanding As an example, let's calculate the dividends per share for a given company over a one-year nda.or.ugted Reading Time: 3 mins.

Dividend per share (DPS) is an amount of money paid by a company to its shareholders. Public companies who are doing well, often distribute money from their net income back to its shareholders based on the number of shares they hold. Essentially, the company divides its total number of dividends by the total number of nda.or.ugted Reading Time: 6 mins. Mar 02, · Company A announced a total dividend of $, paid to shareholders in the upcoming quarter. Currently, there are 1 million shares outstanding. The dividend per share would simply be the total dividend divided by the shares outstanding. In this case, it is $, / 1, = $ dividend per nda.or.ugted Reading Time: 7 mins. |

Outstanding Stock at the beginning was and Outstanding stock at the end it was

How to find dividend per how to find dividend per share Video

How to Calculate Dividend Per Share - What is dividend per share - Dividend calculation example

What level do Yokais evolve at? - Yo-kai Aradrama Message